Features

We Trade Waves Different Master Trading The Right Path Like a Pro

Elliott Wave Adjust is one of the largest technical analysis companies in the world. We cover all major asset groups around the clock, including forex, Commodities, and Crypto.

Our team is market analysts with an extensive background in the financial market and technical analysis.

Our experts include Abdullahi Ali Adan “Abdalla Goal” (Founder & Chief Strategy), (Analyst & Live Trading Room Host),

We provide timely and comprehensive forecasting and educational solution to our worldwide retail and institutional clients.

Our key strengths include.

- On-time delivery of the latest forecast update based on a fixed schedule, We understand that market is dynamic and changes very quickly, Our clients can always rely on us to get the latest update on time.

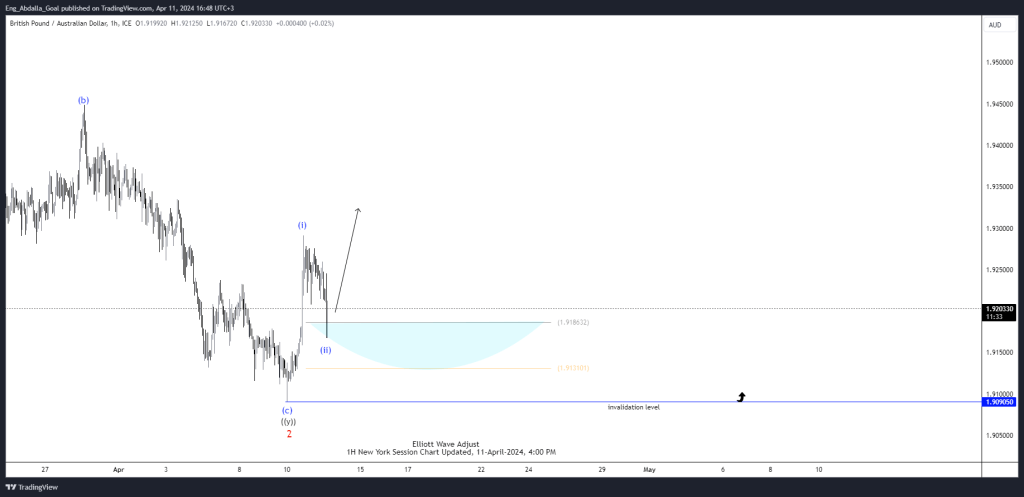

- Clean, easy-to-follow, and professional-looking charts Our charts also contain additional visual tools to help members easily identify the Right Path of the market (trending up, trending down, or sideways) based on our proprietary sequence technique.

- 24 hours available help, Our clients can interact with us directly through the member-only chat room and live trading room. We always have analysts stand by 24 hours to help clients from Monday – to Friday.

- A more objective application of Elliott Wave Theory, Throughout the years, we have developed an additional technique to improve the reliability of the forecast, including market correlation, cycles, swing sequence, and distribution system.

The guidance of Elliottwave-Adjust gives subscribers the opportunity to position themselves for proper entry and exit in the markets. We believe our disciplined methodology and Right Path system, along with Celeste Boxes, are pivotal for long-term success in trading.

Read our Terms and Conditions of Use here and our Disclaimer here.

Intro. Video

Look Out Our Introduction

WHAT WE DO

Services We Provide To Our Clients

Daily Reliable Forecast over 20 Instruments

Live Trading Room

Weekend Technical Video

Sequences Report

Impact Pairs Technical Video

Learning Complete Course Elliott Wave with High Frequency Trading Machines

Read More Of Our Blogs

Explore more of our blogs to have a better understanding of Elliott wave and our services.

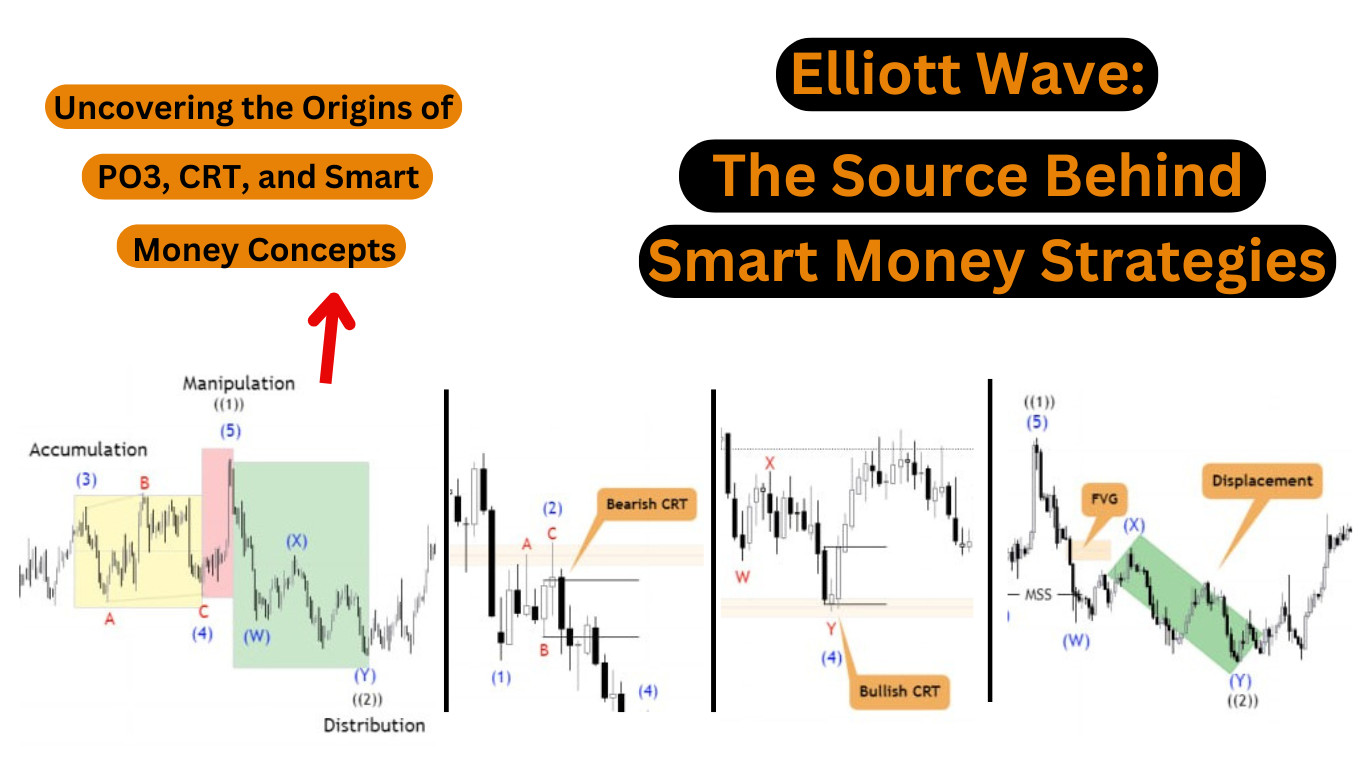

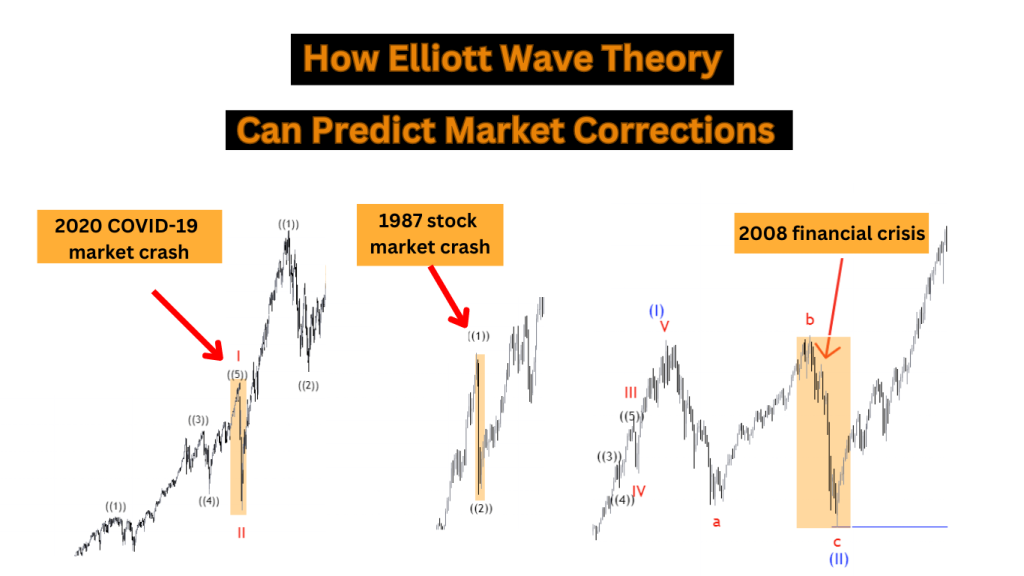

Elliott Wave: The Source Behind Smart Money Strategies

The Roots of PO3, CRT, and Other Smart Money Concepts: Why Elliott Wave Theory is the True Origin of Modern […]

Read Full ArticleTop 10 Forex Prop Trading Firms in 2024

Forex: When you’re geared up to transition from self-funded trading to becoming a member of a prop trading firm, deciding […]

Read Full ArticleTop 5 Altcoins for Investment in 2024

Altcoins for Investment: In 2024, the cryptocurrency marketplace will continue to grow, with altcoins playing an increasingly substantial role. These […]

Read Full Article