1) Elliott Wave Theory: Current idea on 21st Century Markets

History

Basic Principles of Elliott Wave Theory 1930s Waves Theory

Five Wave Patterns (Motive waves and Corrective waves)

4 Wave degree

2) Fibonacci

Introduction

Fibonacci Summation Series

Fibonacci Ratio Table

Fibonacci Retracements and Extensions

Relationship between Fibonacci and Elliott Waves

3) Motive waves

4) Correcting wave

3) Triangle

4) Double Three

5) Triple Three

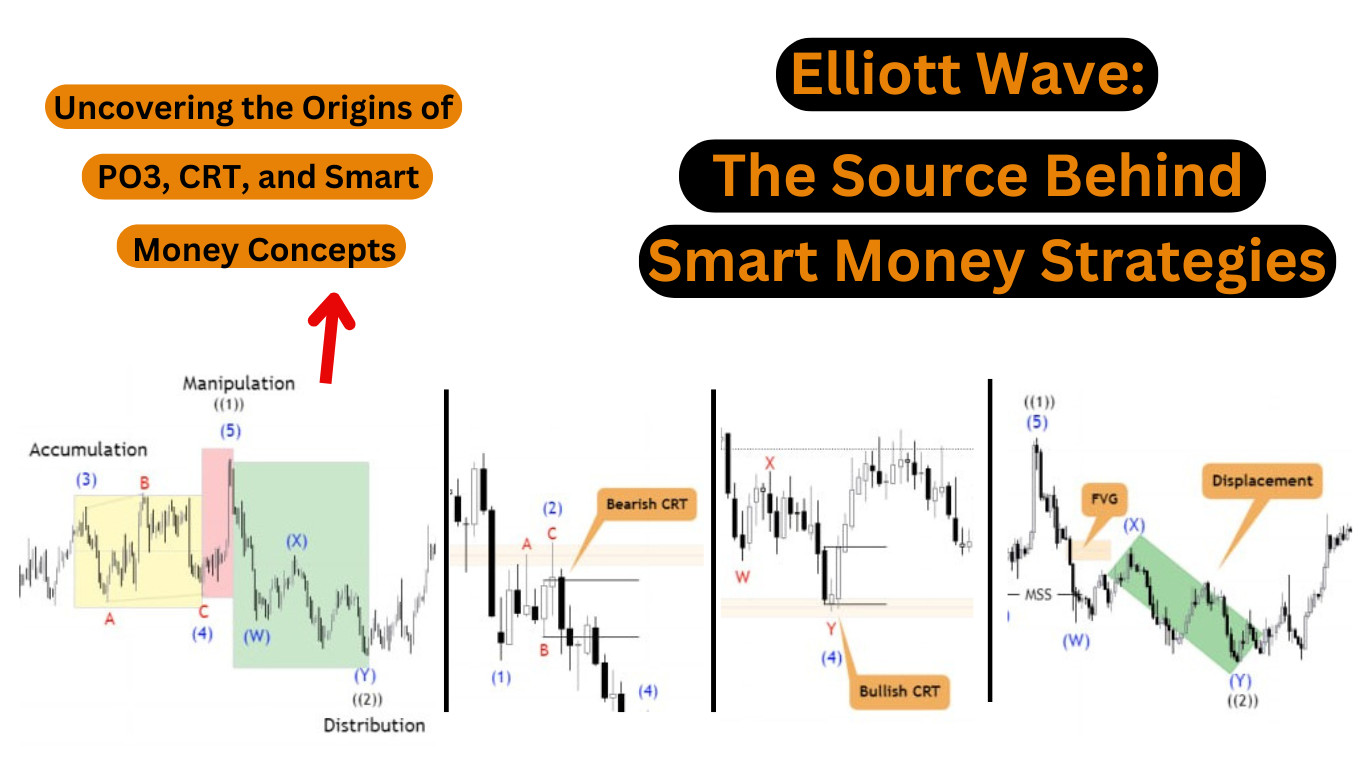

1) Elliott Wave Theory: Current Ideas About 21st Century Markets

Elliott Wave Theory was developed by Ralph Nelson Elliott in the 1930s and provides a unique perspective on stock market movements.

Contrary to the idea that market movements are random and chaotic, Elliott discovered repeating patterns in stock price movements.

By analyzing these patterns, he was able to make detailed market predictions and gain a deeper understanding of market behavior.

Elliott was inspired by the Dow Theory, which explains price movements in the form of waves.

But he went a step further and recognized the fractal nature of market behavior.

Elliott outlined his theory of market patterns in his book The Wave Principle, published in 1938.

1.2 Basic Principles of Elliott Wave Theory in the 1930s

The central principle of Elliott Wave Theory is that a market trend consists of a five-wave impulse movement in the direction of the trend, followed by a three-wave corrective movement against the trend.

It is derived from this observation.

These waves are labeled 1, 2, 3, 4, and 5 for impulse waves, and a, b, and c for correction waves.

It is important to note that Elliott waves can be observed on both long-term and short-term charts.

Additionally, you can also identify small patterns within larger patterns, just as small pieces of broccoli resemble larger pieces.

This understanding, combined with the Fibonacci relationships between waves, allows traders to predict and identify trading opportunities with favorable risk-to-reward ratios.

Key Insights

Elliott Wave Theory is a type of technical analysis that identifies recurring price patterns caused by changes in investor sentiment and psychology.

An impulse wave represents a trend, and a correction wave cancels the trend.

waves are nested within groups of larger waves, creating a fractal investment approach.

1.3 Five Waves Pattern (Motive and Corrective)

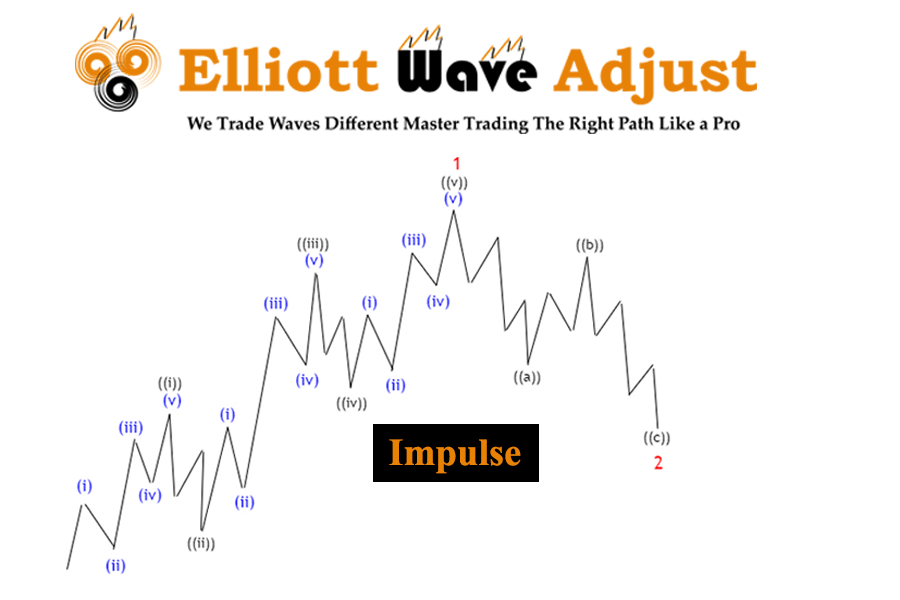

Figure 1

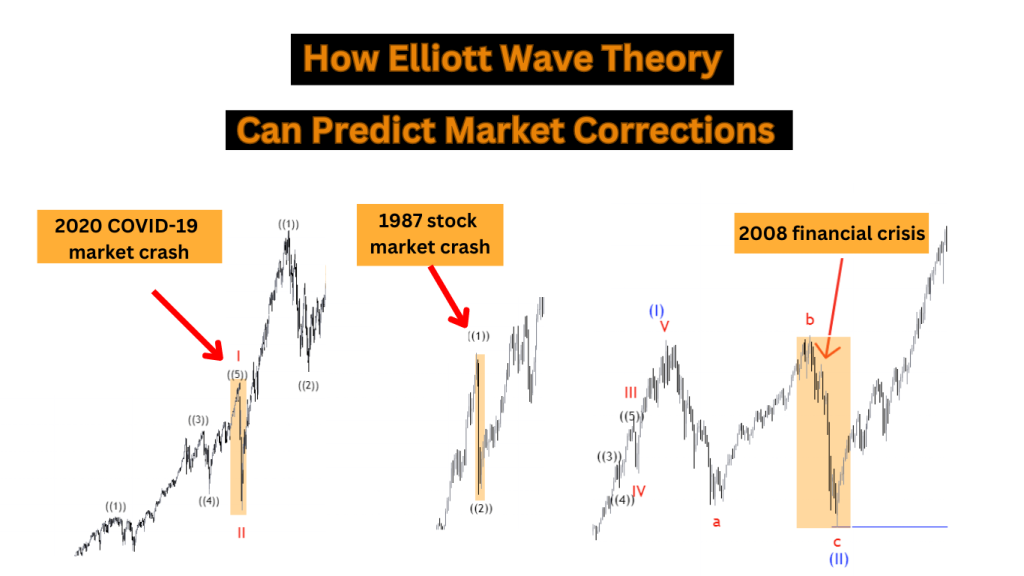

In the Elliott model, market prices alternate between an impulse and a correction phase on all time scales.

An impulse consists of five waves of smaller degrees, where waves 1, 3, and 5 are impulses, while waves 2 and 4 are smaller retracements of waves 1 and 3.

Figure 1 is a visual representation of the wave form pattern.

Motive move (1, 3, 5) are further divided into five smaller waves ((i)), ((ii)), ((iii)), ((iv)), ((v)).

On the other hand, correction wave forms 2 and 4 are divided into three smaller wave forms: ((a)), ((b)), and ((c)).

The five waves combine to form a larger motive move (1).

In a bear market, the pattern reverses, with five waves going down and three waves going up.

1.4 Wave Degree

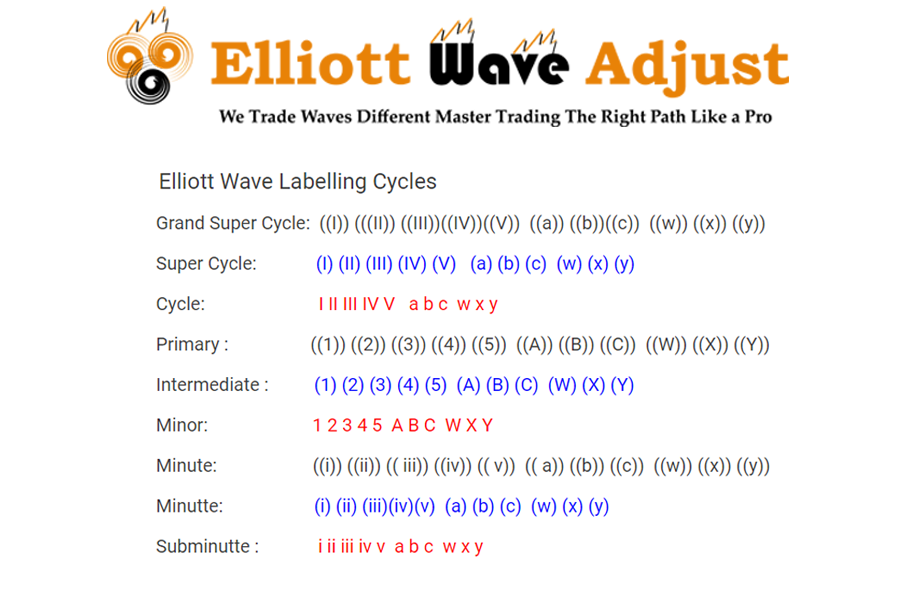

to identify cycles in the development of overall markets, Elliott introduced the concept of “wave frequency.

It divides the waves into nine levels, from the major supercycle also called (Grand super cycle ) level (weekly and monthly time frames) to the sub-minuettee degree (time frames).

This frequency scheme, shown in Figure 2, is used in all Elliott Wave Adjust charts.

Figure 2

Knowing the magnitude of a wave helps analysts understand the wave’s place within the larger market trend.

Overall, Elliott Wave Theory provides traders and analysts with a unique perspective on market behavior.

Recognizing repeating patterns and the fractal nature of markets can give investors insight into future price movements and help them make more informed trading decisions.

2) Fibonacci

2.1 Introduction

Leonardo Fibonacci da Pisa was his 13th century mathematician who discovered the Fibonacci sequence.

In 1242 he published a treatise called Liber Abacci, which introduced the decimal system.

This study is based on his two years of research on the Pyramids of Giza.

Fibonacci is best known for his series of Fibonacci sums that enabled the Old World in the 13th century to switch from Roman numerals (XXIV = 24) to the Arabic numerals used today (24).

Fibonacci received the Nobel Prize today for his work in mathematics.

2.2 Fibonacci Summation Series

Leonardo One of his most popular discoveries of his Fibonacci is the Fibonacci Summation Series.

This line takes 0 and adds 1 to the first two numbers.

Subsequent numbers in a series are created by adding the previous two numbers, ranging from 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89 to infinity.

The golden ratio (1.618) is found by dividing a Fibonacci number by another previous Fibonacci number in the series.

For example, 89 divided by 55 is 1.618.

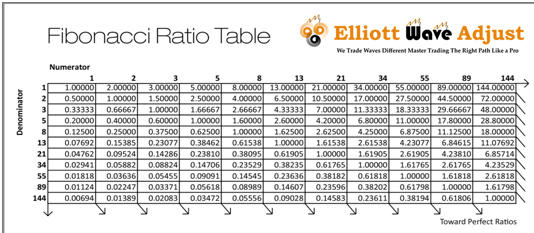

2.3 Fibonacci Ratio Table

The table shown below allows you to create different Fibonacci ratios by dividing one Fibonacci number (numerator) by another Fibonacci number (denominator).

These indicators, and some derived from them, occur everywhere in nature and in financial markets.

These often indicate strong resistance and support levels.

They are easily recognized in nature (as the whorls of seashells, flower petals and the structure of tree branches), in art, geometry, architecture and music.

Figure 3

Some of the most important Fibonacci ratios can be derived as follows.

- 0.618 is found by dividing any Fibonacci number in the sequence by the other Fibonacci number that immediately follows it, Example 1 : 8 divided by 13 or 55 divided by 89.

- 0.382 is obtained by dividing any Fibonacci number in the sequence by another Fibonacci number two positions to the right of the sequence,For example, 34 divided by 89

- 1.618 (the golden ratio) is found by dividing any Fibonacci number in the sequence by another Fibonacci number one position to the left of the sequence,For example, 89 divided by 55, and 144 divided by 89

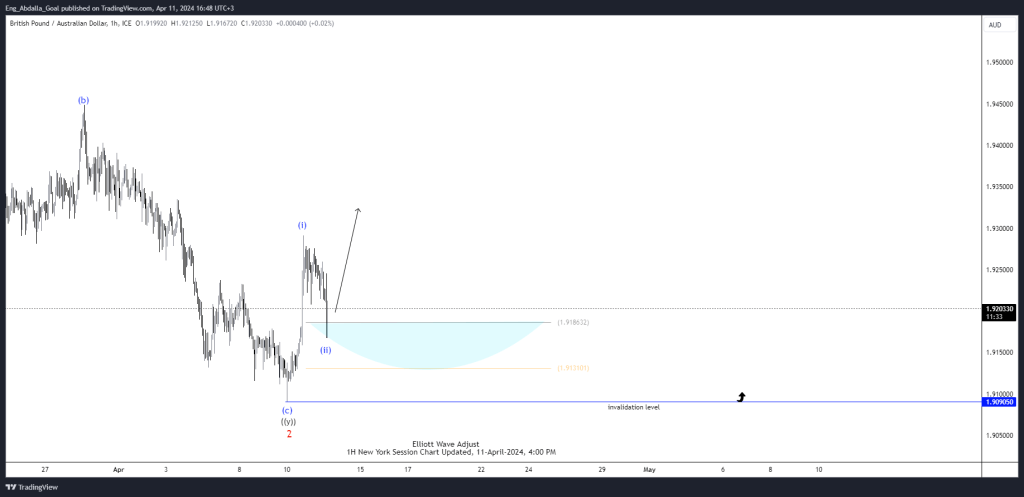

2.4 Fibonacci retracements and extensions

Fibonacci retracements in technical analysis and Elliott wave theory refer to market corrections (countertrends) that turn into support – or where support areas are expected Resistance is indicated by major Fibonacci values.

The market is then expected to reverse and continue trending in the main direction.

Fibonacci extension refers to the movement of the market according to the main trend into support and resistance areas of the main Fibonacci levels against which target profits are measured.

Traders use Fibonacci expansion to determine target profits.

Below is a list of Fibonacci retracement and Fibonacci extension ratios that are important for financial markets:

Figure 4

2.5 Relationship between Fibonacci and Elliott Wave Theory

Fibonacci ratios help measure wave targets Movement within an Elliott wave structure.

The different waves in the Elliott Wave structure are connected by Fibonacci ratios.

Example: Pulse wave:

- Wave 2 is typically 50%, 61.8%, 76.4% or 85.4% of Wave 1

- Wave 3 is normally 161.8% of Wave 1

- Wave 4 is typically 14.6%, 236% or 38.2% of Wave 3

- Wave 5 is typically equal to 1.236 – 1.618% of reverse wave 4 and 61.8% of wave 1 or wave 1+3

Therefore, traders can use the above information to set entry points and profit targets when placing trades, you can decide.

3) Motive Waves

Elliott argued that financial price movements are determined by the general sentiment of investors.

He found that fluctuations in public opinion in financial markets always exhibited the same fractal or “wave” pattern.

” “Elliott Theory is similar to Dow Theory in that stock prices fluctuate in waves.

However, Elliott was more aware of the “fractal” nature of the market, which allowed him to segment it and analyze it in more detail.

A fractal is a mathematical structure that repeats infinitely on smaller scales.

Elliott discovered that patterns in stock indexes are structured in a similar way.

He then began thinking about how these recurring patterns could be used as indicators to predict future market movements.

In Elliott wave theory, the traditional definition of a motif wave is a large trend consisting of five waves in the same direction.

The Motion Wave (also known as the motion wave) has three different impulse waves: Impulse with an extended wave and a diagonal.

EWA prefers to define the wave motif differently.

I agree that motif waves move in the same direction as the trend, and I also agree that the 5 waves are motif waves.

However, we believe that the motive wave pattern does not necessarily consist of five waves.

Today’s market seems to be divided into three waves of motivation.

For this reason, we prefer to call it sequences.

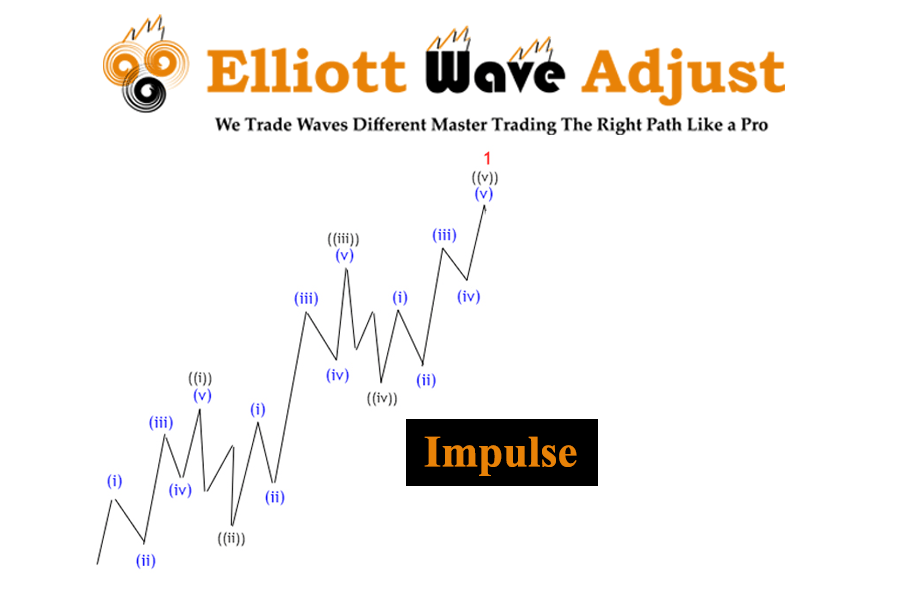

3.1 Impulse

Figure 5

Instructions

The Impulse move is divided into 5 moves.

In figure 2, the impulse wave is divided into 1, 2, 3, 4 and 5 in small degrees.

Waves 1, 3, and 5 are impulses.

In this case, the classifications are ((i)), ((ii)), ((iii)), ((iv)), and ((v)).

Wave 2 cannot go back further than the start of wave 1.

Wave 3 cannot be the shortest of the three impulse moves, 1, 3, and 5.

Wave 4 cannot reach the area of wave 1.

Wave 5 must also be a momentum divergence.

Relationship of Fibonacci ratios

- Wave 2 typically retraces 50%, 61.8%, 76.4%, or 85.4% of Wave 1.

- Wave 3 is 161.8 of wave 1-2%, 200%, 261.8%, or 323.6.

- Wave 4 is 14.6%, 23.6%, or 38.2% of wave 3, but does not exceed 60%.

- There are three different steps to measure wave 5.First, wave 5 is a 123.6 to 161.8% reverse retracement of wave 4Second, wave 5 corresponds to wave 1.Third, wave 5 represents 61.8 % of waves 1 to 3.

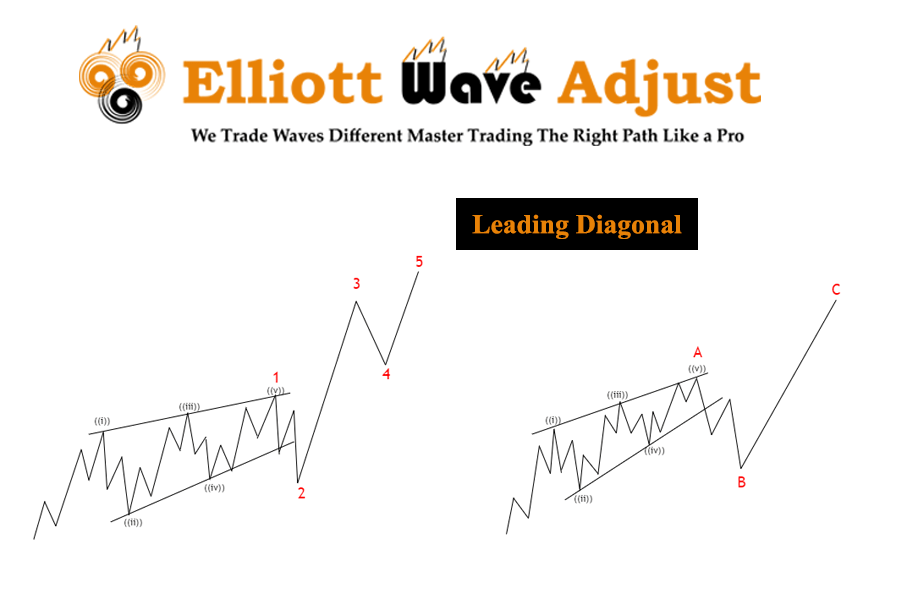

3.2 Leading diagonal

Figure 6

Instructions

- A special type of leading wave appears as a wave 1 minor subdivision in an impulse or a zigzag wave A minor subdivision in figure 6A, The diagonal is the division of wave 1 into a impulse.

- In Figure 6B, the first diagonal is a small part of zigzag wave A.

- The first diagonal often features an overlap of Waves 1 and 4 and forms a wedge shape. However, the overlap between Waves 1 and 4 is not a requirement and may or may not occur.

- The division of the first diagonal can be 5-3-5-3-5 or 3-3-3-3-3, The above examples show that the first diagonal has a division of 5-3-5- 3-5.

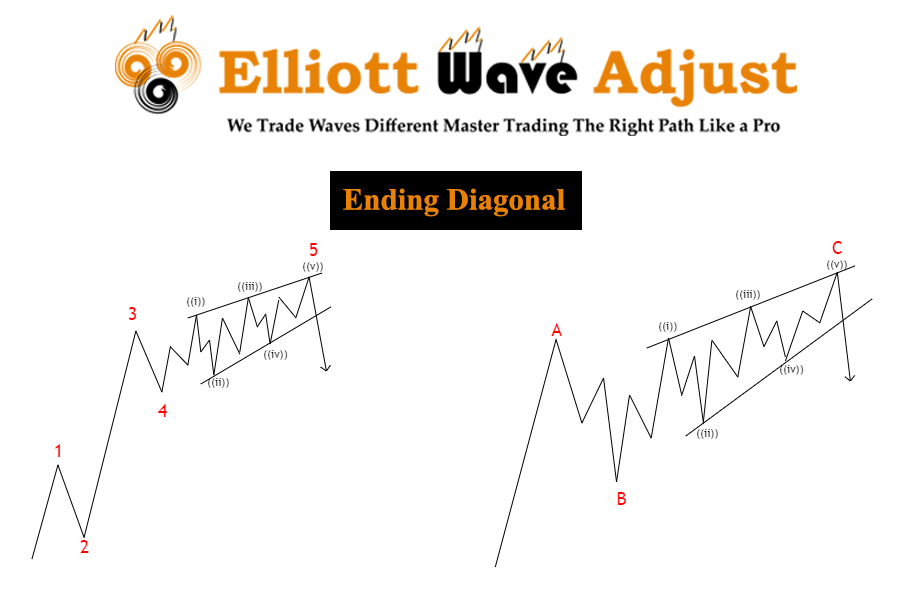

3.3 Ending Diagonal

Figure 7

Instructions

- The special type of driving wave appears as a division of wave 5 in an impulse or a division of wave C in a zigzag pattern In Figure 7A, the ending diagonal is a division of wave 5 in an impulse.

- In Figure 7B, the final diagonal is part of zigzag wave C.

- The final diagonal is often characterized by the overlap of waves 1 and 4 as well as the shape of a wedge, However, the overlap between wave 1 and wave 4 is not conditional and may or may not occur.

- The last diagonal is divided into five segments, each consisting of three waves like this: 3-3-3-3-3

4) Corrective Waves

There are five types of corrective patterns:

- Zigzag (5-3-5)

- Flat (3-3-5)

- Triangle (3-3-3-3-3)

- Double three: is combination of two corrective patterns.

- Triple three: is Combination of three corrective patterns

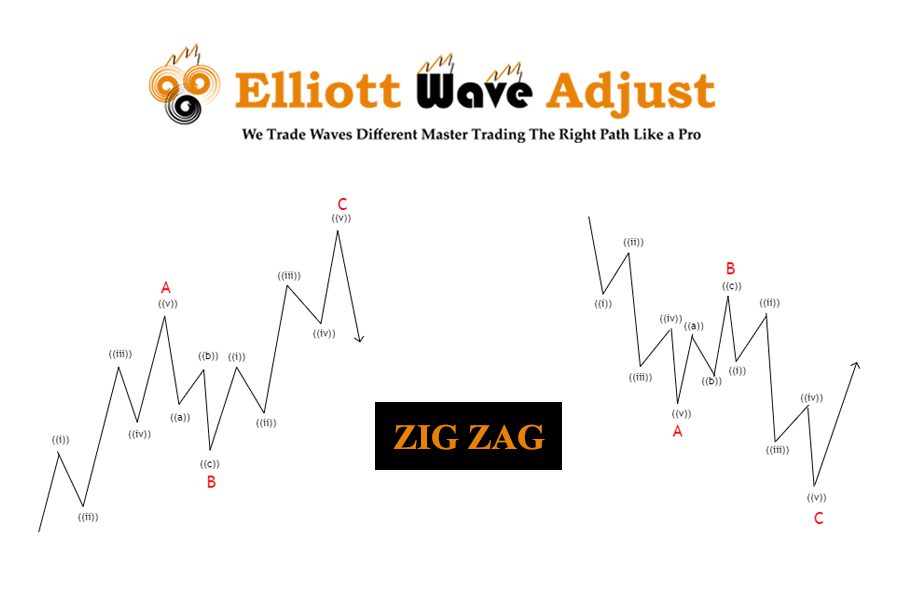

4.1 Zigzag

Figure 8

Instructions

- Zigzag is a 3-wave corrective structure labeled as ABC Wave A and C division is 5 waves, impulse or diagonal.

- Wave B can be any corrective Pattern Zigzag is a 5-3-5 structure move.

Relationship of Fibonacci ratios

- Fib Retracement of Wave B = 50%, 61.8%, 76.4% or 85.4% of wave A

- Wave C is often 61.8%, 100%, or 123.6% of Wave A. If Wave C reaches 161.8% of Wave A, it might actually be Wave 3 of a five-wave impulse.

So one way to label between ABC and pulse is whether the third swing lasts or not.

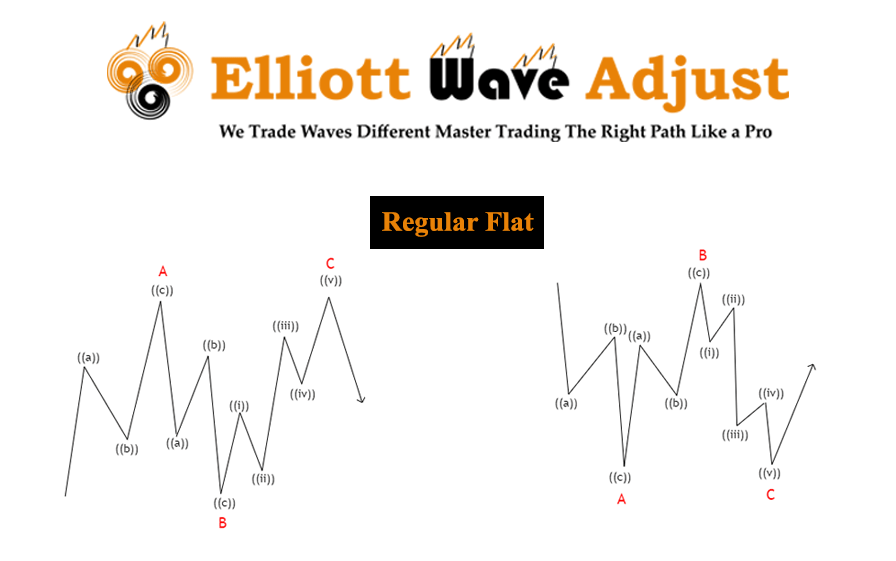

4.2 Flat

Flat correction is a 3-wave correction movement labeled ABC.

Although labeled the same, flat is different from zigzag in wave A subdivision.

While Zigzag is a 5-3-5 structure, Flat is a 3-3-5 structure.There are three different types of Flat Patterns: Regular Flat, Irregular / Expanded Flat and Running.

Figure 9

Instructions

3-wave corrective movement labeled ABC Division of waves A and B within 3 waves Partition of wave C consisting of 5 impulse waves /diagonal The division of waves A and B can belong to any 3-wave correction structure, including zigzag, flat, double three, triple three Wave B ends near the start of wave A Wave C usually ends slightly further than the end of wave A Wave C must have a momentum divergence.

Relationship of Fibonacci ratios

- Wave B = 90% of wave A

- Wave C = 61.8%, 100 % or 123, 6% wave AB

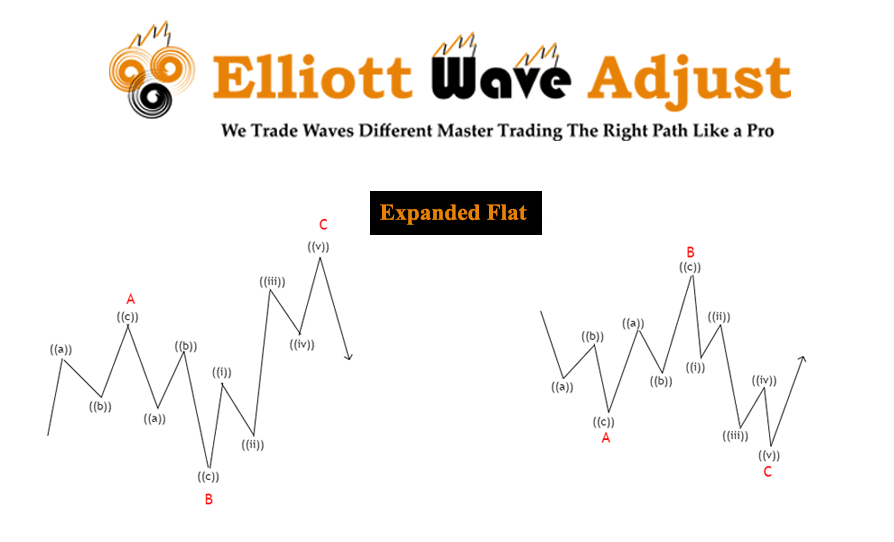

4.2.2 Expanded Flats

Figure 10

Instructions

- A 3-wave corrective move labeled ABC.

- The division of waves A and B into 3 waves.

- The division of wave C into 5 impulses (diagonal).

- The division of waves A and B can be at any structure of the 3-wave pattern, including zigzag, flat, double–three, and triple .

- Wave B of the 3-3-5 pattern ended beyond the start of wave A.

- Wave C ended significantly beyond The final level of wave A.

- Wave C must have momentum divergence.

- Wave B = 123.6% of move A.

- Wave C = 123.6% – 161.8% of move AB.

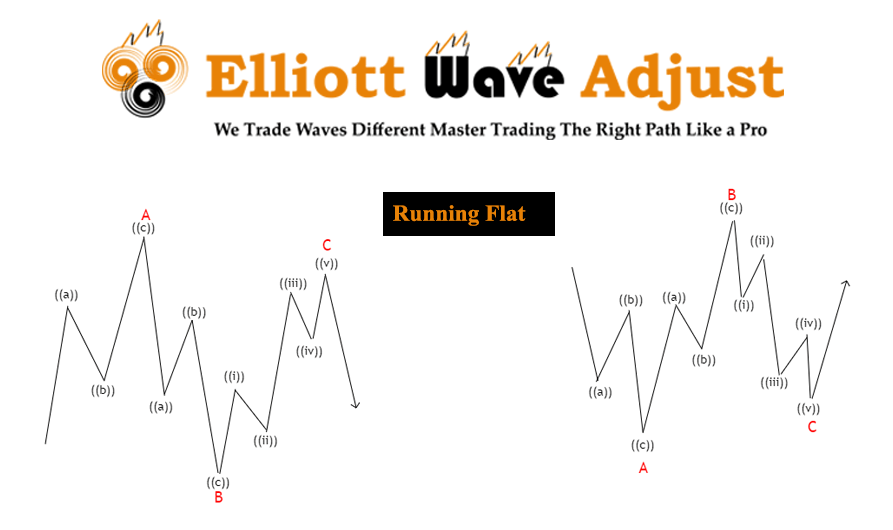

4.2.3 Running Flats

Figure 11

Instructions

Corrective wave 3 waves labeled ABC Division of waves A and B within 3 waves The division of wave C includes 5 impulses / Diagonal wave, Wave A and B can have a corrective structure any of the 3 waves, including zigzag, flat, double three, and triple three Wave B of the 3-3-5 pattern ends beyond the start of wave A, as in an expanding plane Wave C does not travel all the way down from the level where wave A Ends Wave C must have divergent momentum

Relationship of Fibonacci ratios

- Fib Ratio of Wave B = 123.6% of wave A

- Fib Ratio of Wave C = 61.8% – 100% of Wave AB

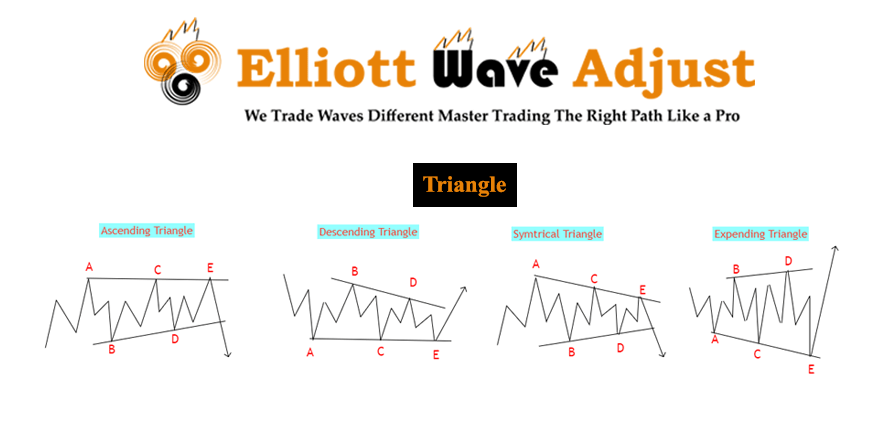

4.3 Triangles

A triangle is a sideways movement associated with a decrease in volume and volatility.

The triangle has 5 sides, and each side is divided into 3 waves,, forming a 3-3-3-3-3 structure.

There are 4 different types of triangles in Elliott Wave Theory: ascending, descending, contracting and expanding.

They are shown figure 12 in the below.

Figure 12

Instructions

- Corrective structure labeled ABCDE

- Normally, it occurs in wave B or wave 4

- Divides into three (3-3-3-3-3)

- RSI must also support the triangle in each period of The divergence

- The Minor Division of ABCDE can be either abc, wxy or flat

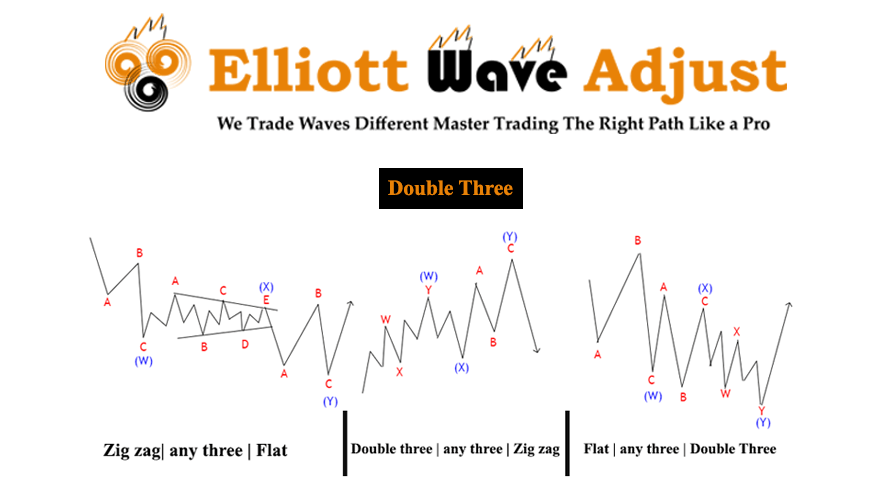

4.4 Double Three

The double triple is a sideways combination of two corrective patterns.

We have examined several corrective patterns, including zigzag, flat, and triangle.

When combining two of these corrective models, we get a double-three Additionally,

Instructions

- Combination of two corrective structures labeled WXY

- Move W and Y can be subdivided into zigzag, flat, double three, or triple three patterns at a lower degree.

- Move X can be any corrective structure

- WXY is a 7-swing Pattern

Relationship of Fibonacci ratios

- Fib Retracement of Wave X = 50%, 61.8%, 76.4%, or 85.4% of wave W.

- Fib Ratio of Wave Y = 61.8%, 100 % or 123.6% of wave W.

- The fiber ratio of Wave Y cannot exceed 161.8% of wave W.

Below are examples of different combinations of the two structures: correction forms, double-three Pattern:

Figure 13

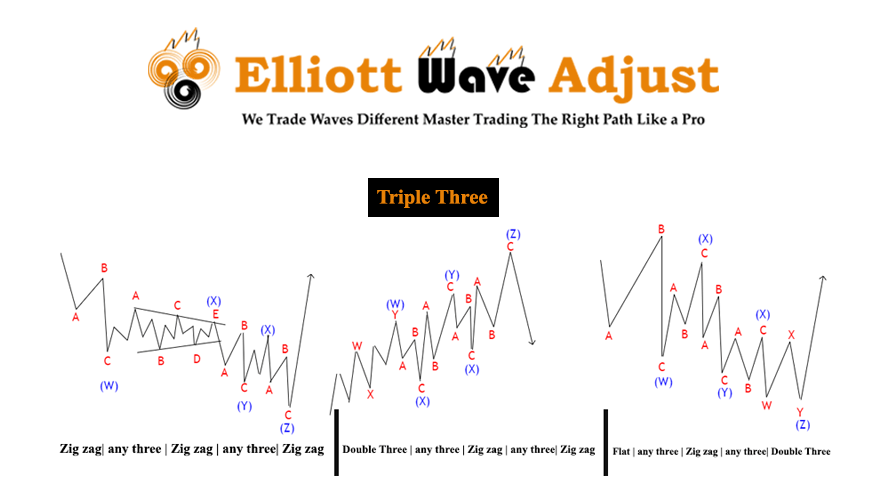

5.5 Triple Three

A triple is a sideways combination of three corrective structures in Elliott Wave Theory.

Instructions

- Combination of triples: the corrective measure structure is labeled WXYXZ

- The division of wave W, wave Y and wave Z can be zigzag, flat, triple to a lower degree, or triple to a lower degree.

- Wave X can be any corrective structure.

- WXYZ is an 11-swing structure.

Relationship of Fibonacci ratios in Elliott wave theory

Fib Retracement of Wave X = 50%, 61.8%, 76.4%, or 85.4% of wave W

- Wave Z = 61.8%, 100% or 123.6% of the wave W

- Wave Y cannot exceed 161.8% of wave W; otherwise, it can become impulse wave 3

Here is an example of different combinations of three corrective structures that form a triple: