Forex Trading Timetable: The unfamiliar trade market, otherwise called the unfamiliar trade market, is the biggest and most fluid monetary market on the planet. With trillions of dollars traded each day, there are many open doors for dealers to create gains. However, to take full advantage of these open doors, it is vital to comprehend the importance of timing in forex trading.

Overview to Forex Trading Timetables

In the sector of forex trading, timing is everything. Mastering your trading timetable can make all the difference between success and missed opportunities. As seasoned traders know, understanding the nuances of when to alternate can significantly effect profitability and risk control strategies.

The foreign exchange market, unlike traditional stock exchanges, operates 24 hours an afternoon, 5 days a week. This non-stop cycle of trading offers a unique landscape for traders around the world. To navigate this dynamic marketplace effectively, it’s important to understand the concept of trading sessions and the way they overlap.

The Role of News and Events in Timing Trades

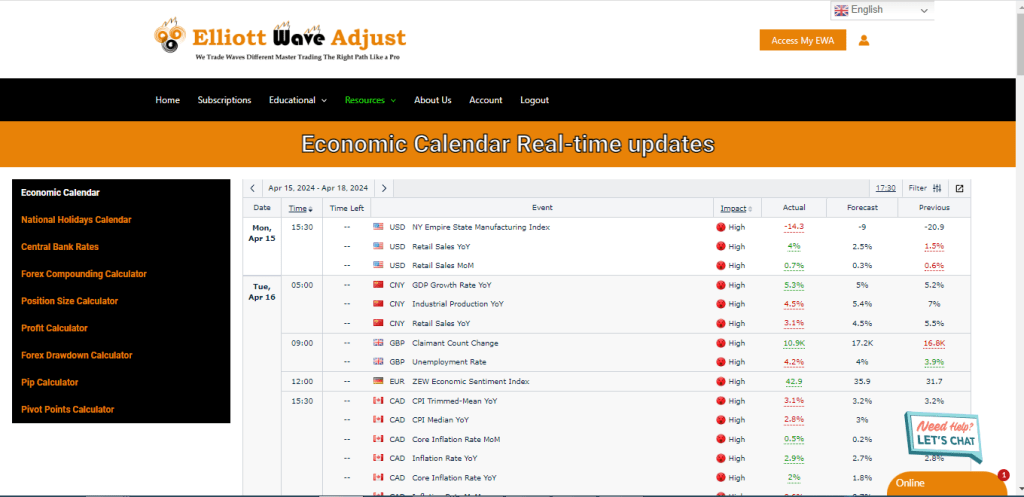

Incorporating News Calendars and Event Schedules

Start by often consulting news calendars and event schedules to stay knowledgeable about upcoming financial releases, relevant financial institution announcements, geopolitical events, and different market-transferring news. Websites and platforms like Elliott Wave Adjust, Investing.com, Forex Factory, and Bloomberg provide comprehensive calendars that list scheduled activities and their expected effect on currency pairs. By incorporating this information into your trading schedule, you can anticipate potential volatility and adjust your trading strategy accordingly.

Strategies for Trading Around Major Economic Announcements

Major economic announcements, consisting of non-farm payroll reviews, GDP releases, and interest rate decisions, can cause considerable fluctuations in foreign money prices. To capitalize on those opportunities, remember to implement specific trading strategies tailored to every occasion. For example, a few investors may additionally select to enter positions shortly before an announcement, hoping to profit from the initial price reaction, while others may prefer to wait for the dust to settle before entering trades. Additionally, using risk management techniques together with setting forestall-loss orders can help mitigate capability losses during periods of heightened volatility.

Key Forex Trading Sessions

Asian Session: Characteristics and Major Currency Pairs Traded

The Asian session kicks off the trading day, encompassing financial facilities that include Tokyo, Singapore, and Hong Kong. This session is known for its relative balance and is often marked by lower trading volumes in comparison to other sessions. Major currency pairs traded during this session include USD/JPY, AUD/USD, and NZD/USD.

European Session: Timing and Liquidity During the European Trading Hours

As the Asian session comes to a close, the European session takes center stage. With London as its primary hub, this session boasts excessive liquidity and volatility, making it a favorite among traders globally. Major forex pairs traded throughout the European session include of EUR/USD, GBP/USD, and USD/CHF.

North American Session: Features and Overlap with Other Sessions

The North American session, centered around New York, overlaps with both the Asian and European sessions, creating a period of heightened activity. This session is characterized by increased volatility, driven by economic data releases and marketplace sentiment. Major currency pairs traded during the North American session include USD/CAD, USD/JPY, and EUR/USD.

Choosing Your Ideal Trading Times

Assessing Personal Availability and Trading Preferences

When determining your ideal trading times, it is vital to keep in mind your personal schedule and preferences. Some investors thrive in the fast-paced environment of the European session, even as others pick the relative calm of the Asian session. By aligning your trading hours with your availability and temperament, you may optimize your overall performance in the market.

Identifying the Most Active Trading Hours for Preferred Currency Pairs

Each currency pair exhibits its own unique trading patterns, influenced by factors such as economic data releases and geopolitical events. By figuring out the maximum energetic trading hours for your selected foreign money pairs, you may capitalize on opportunities for earnings while minimizing danger. Utilizing equipment together with monetary calendars and market analysis reviews can help you become knowledgeable and make knowledgeable trading decisions.

Considering Volatility and Liquidity Factors During Different Sessions

The two main factors influencing charge changes in the foreign exchange market are volatility and liquidity. Fees can fluctuate wildly during times of extreme volatility, offering buyers both possibilities and risks. On the other hand, liquidity describes how easily a currency pair can be bought or sold without significantly changing its price. You can modify your purchasing and selling approach by understanding how these components change during great buying and selling sessions.

Optimal Times for Major Currency Pairs

When it comes to trading major currency pairs like EUR/USD, GBP/USD, and USD/JPY, timing is crucial. Analyzing historical price movements can provide valuable insights into peak trading times for each pair. For example, the EUR/USD tends to experience increased volatility during the overlap of the European and North American sessions, typically between 8:00 AM and 12:00 PM EST. Similarly, the GBP/USD often sees heightened activity during the London session, which runs from 3:00 AM to 11:00 AM EST. As for the USD/JPY, it often experiences significant price movements during the overlap of the Asian and European sessions between 2:00 AM and 4:00 AM EST.

Understanding Market Overlaps

Session overlaps play an important role in using volatility inside the forex market. One of the most significant overlaps takes place between the London and New York sessions, usually between 8:00 AM and 12:00 PM EST. During this time, traders can capitalize on expanded liquidity and volatility, making it a super time for executing trades. Strategies for maximizing earnings at some point of overlap intervals consist of focusing on foreign money pairs, which might be most active for the duration of these hours, and closely monitoring economic information releases and geopolitical events that can effect prices.

Factors Affecting Trading Timetables

Several factors can have an effect on trading timetables, which includes economic data releases, central bank announcements, and seasonal traits. Economic indicators, together with GDP growth, inflation costs, and employment figures, can appreciably effect marketplace volatility and foreign money costs. Central bank bulletins, along with hobby rate selections and monetary coverage statements, can also explain sharp actions in forex markets. Additionally, seasonal trends, along with holiday intervals and geopolitical events, can affect trading activity in unique areas, leading to shifts in market sentiment and price moves.

Adapting to Different Time Zones

Traders operating in specific time zones face specific challenges with regards to optimizing their trading schedules. To successfully navigate these challenges, investors can leverage computerized trading gear to execute trades at some point during off-hours, while liquidity can decrease. Additionally, adopting strategies for handling sleep styles and maintaining overall height can help traders stay focused and alert throughout key trading classes. By aligning their trading activities with best market situations and staying knowledgeable about worldwide monetary traits, traders can maximize their profitability and decrease threat in the foreign exchange marketplace.

Creating a Personalized Trading Schedule

Creating a personalized trading time table is vital for optimizing your trading performance and achieving your monetary goals. By setting specific trading hours based on your man or woman’s preferences and targets, you could maximize your efficiency and effectiveness within the foreign exchange market. Here are a few steps to help you create a customized trading time table:

Setting Specific Trading Hours

Begin through figuring out the unique times of day that align with your trading dreams and lifestyle. Consider elements which include your availability, time zone, and preferred trading sessions. For example, if you’re a morning character, you can focus your attention on trading throughout the European consultation, which commonly begins at 3:00 AM EST. Alternatively, if you have an afternoon process, you could need to schedule your buying and selling activities at some point during the nighttime hours or on weekends.

Incorporating Breaks and Rest Periods

It’s vital to incorporate breaks and relaxation intervals into your trading routine to avoid burnout and maintain focus. Trading can be mentally and emotionally demanding, so taking regular breaks can help refresh your mind and prevent selection fatigue. Consider scheduling quick breaks every few hours to stretch, hydrate, and clear your mind. Additionally, make certain to get an adequate quantity of sleep every night to ensure the best cognitive performance throughout trading hours.

Establishing Consistency and Discipline

Consistency and discipline are keys to successful trading. Once you’ve got established your personalized trading time table, commit to sticking to it always. Avoid the temptation to deviate from your agenda or overtrade based on feelings or impulses. Instead, focus on executing your trading plan with discipline and patience, irrespective of marketplace conditions. By adhering to your timetable and retaining a constant technique for trading, you can build confidence in your abilities and increase your chances of long-term success in the foreign exchange marketplace.

Master Your Forex Trading Timetable: Tips for Ideal Trading Times

Dissimilar to other monetary business sectors, forex works 24 hours per day, 5 days every week. This nonstop trading program makes it conceivable that the market is decentralized, with trading centers situated in various time regions all over the planet. Thus, forex brokers have the adaptability to pick when they need to trade. In any case, not all trading hours are equivalent. Certain times offer better trading conditions and more noteworthy liquidity, which can fundamentally affect trading results.

One of the vital elements to consider while mastering a forex trading program is market liquidity. Liquidity alludes to the straightforwardness with which a resource can be traded without causing huge cost variances. When a market is exceptionally fluid, dealers can enter and leave positions at desired costs. Then again, low liquidity can cause slippage, where the executed cost varies from the normal value because of an absence of accessible purchasers or vendors.

The most fluid trading meetings happen when at least two important monetary foci cross over. These cover periods of high trading action and expanded liquidity, making them ideal periods for forex trading. The three fundamental trading meetings to keep an eye out for are the Asian meeting, the European meeting, and the US meeting.

The Asia Meeting, otherwise called the Tokyo Meeting, starts at midnight GMT and finishes at 9:00 a.m. GMT. This meeting is described by generally low unpredictability and liquidity compared with different meetings. However, it should not be overlooked, as it opens doors to brokers who favor a quieter trading climate. Important money matches connected with the Japanese yen, like USD/JPY and EUR/JPY, have been especially dynamic during this meeting.

The European meeting, or London meeting, is viewed as the most dynamic and liquid meeting. It starts at 7 am GMT and covers the Asia meeting for a few hours. Unpredictability and liquidity will generally increase together during this period because of the dynamic investment of dealers from the two mainlands. Important euro-related money coordinates like EUR/USD and EUR/GBP are the most impacted by this meeting.

The US meeting, otherwise called the New York meeting, starts at 13:00 GMT and covers the European meeting for a few hours. This meeting is known for its high liquidity and unpredictability, as it includes the biggest economies on the planet. Important cash matches connected with the US dollar, like USD/JPY and GBP/USD, will be the most impacted during this meeting. US financial deliveries and national bank declarations can set off large moves on the lookout, making it an interesting time for merchants.

Although the principal trading meetings offer the best trading conditions, it is critical to take note that open doors may likewise emerge beyond these hours. There can be certain money coordinates that show unpredictability at specific times because of financial news releases or international occasions. Brokers who need to trade during calm periods can find potential open doors by focusing on unambiguous money coordinates or utilizing different trading systems, for example, range trading and breakout trading.

As well as understanding ideal trading hours, dealers should likewise think about their own timetable and trading style. A few dealers would like to trade during the quiet meetings in Asia, while others can flourish in the quick-moving climate of the European or US meetings. To expand your odds of coming out on top, it is vital to fit your trading system to your trading technique and personal inclinations.

Mastering the Forex trading program is an expertise that demands investment and experience. Understanding the different trading meetings and their qualities permits brokers to draw informed conclusions about when and what to trade. Having a solid handle on ideal trading times will essentially further develop your trading results and increase your odds of coming out on top of the Forex market.

Understanding Forex Market Timing:

The forex market is partitioned into four fundamental trading sessions: the Sydney session, the Tokyo session, the London session, and the New York session. Every meeting has its attributes and trading times, and understanding them will assist you in distinguishing the best chance to trade.

- Sydney session: The Sydney meeting starts at 10:00 p.m. m. GMT and finishes at 7:00 a.m. m. GMT. This meeting is known for its generally low unpredictability, which frequently brings about little cost development on important money matches.

- Tokyo session: The Tokyo Meeting starts at midnight GMT and finishes at 9:00 a.m. GMT. This meeting covers the Sydney meeting, which increases instability, particularly for the JPY pair.

- London session: The London meeting starts at 8:00 a.m. m. GMT and finishes at 5:00 p.m. m. GMT. This meeting is viewed as the most fluid and has the most noteworthy trading volume, making it the best opportunity to trade important money coordinates like EUR/USD and GBP/USD.

- New York session: The New York Meeting starts at 1:00 p.m. GMT and finishes at 10:00 p.m. GMT. This meeting matches the London meeting, so there will be high unpredictability and trading action, particularly in the USD pair.

The best opportunity to trade:

The best opportunity to trade is during important trading meetings, as this is the point at which the market is generally dynamic and fluid. The cross-over between the London and New York meetings, which happens somewhere in the range of 13:00 and 17:00 GMT, is especially favorable for trading as the two sessions are open and trading volumes are at their pinnacle.

Frequently Asked Questions (FAQs)

Here are answers to some frequently asked questions about forex trading timetables:

What are the best times to trade forex?

The best times to trade forex are during periods of high liquidity and volatility, typically during the overlap of major trading sessions. This includes the overlap of the European and North American sessions (8:00 AM to 12:00 PM EST) and the overlap of the Asian and European sessions (2:00 AM to 4:00 AM EST).

How do I determine the most active trading sessions?

You can determine the most active trading sessions by analyzing historical trading volume and price movements during different times of the day. Major trading sessions, such as the Asian, European, and North American sessions, tend to exhibit higher levels of activity and liquidity compared to other times.

What currency pairs are most liquid during specific trading hours?

Currency pairs with currencies from the major trading economies, such as the EUR/USD, GBP/USD, and USD/JPY, are typically the most liquid during specific trading hours. For example, the EUR/USD is most liquid during the overlap of the European and North American sessions.

Is it possible to trade forex around the clock?

Yes, it is possible to trade forex around the clock, as the forex market operates 24 hours a day, five days a week. However, liquidity and volatility may vary depending on the time of day and the trading session.

How do I adjust my trading schedule for different time zones?

To adjust your trading schedule for different time zones, consider aligning your trading hours with the major trading sessions that overlap with your local time. Additionally, leverage automated trading tools to execute trades during off-hours when liquidity may be lower.

What impact do economic events have on trading timetables?

Economic events, such as central bank announcements, GDP releases, and employment reports, can have a significant impact on trading timetables by influencing market volatility and sentiment. Traders often adjust their trading strategies and schedules in anticipation of these events to capitalize on potential opportunities or mitigate risks.

Should I avoid trading during low liquidity periods?

It’s generally advisable to avoid trading during low liquidity periods, as spreads may widen and price movements may be more unpredictable. Low liquidity environments can increase the risk of slippage and may make it more challenging to execute trades at desired prices.

How can I optimize my trading schedule for maximum profitability?

To optimize your trading timetable for maximum profitability, consider factors such as your personal schedule, preferred trading sessions, and market conditions. Regularly review and adjust your timetable based on changing circumstances, and seek feedback from mentors or trading communities for further optimization.

What tools can help me monitor market openings and closures?

Several tools can help you monitor market openings and closures, including forex calendars, trading platforms, and mobile apps. These tools provide real-time updates on market hours, upcoming economic events, and trading session overlaps, allowing you to stay informed and plan your trading activities accordingly.

How often should I review and adjust my trading schedule?

It’s recommended to review and adjust your trading schedule regularly, ideally on a weekly or monthly basis. This allows you to stay adaptable and responsive to changing market conditions, economic developments, and personal circumstances, ensuring that your trading timetable remains optimized for success.