In the constantly changing world of financial analysis, Machine Learning (ML) and Elliott wave theory (EWT) are becoming essential tools. Combining these two methods could transform market forecasting, providing exceptional accuracy and insights. This article covers the basics of both machine learning and Elliott Wave Theory, looks at how they intersect, and shows how their combination can lead to new breakthroughs in financial analysis.

Overview of Machine Learning

Definition and Basic Concepts

Machine learning is a branch of artificial intelligence that creates systems able to learn from data, recognize patterns, and make decisions with little human help. The main idea of ML is that algorithms learn from data repeatedly to get better over time.

Importance in Modern Technology

Machine Learning is now a key part of modern-day generation. It is used in lots of areas, consisting of healthcare, finance, retail, and entertainment. By the use of large quantities of statistics and advanced algorithms, ML helps organizations make decisions based on data, improve customer experiences, and streamline operations.

Introduction to Elliott Wave Theory

Historical Background

Elliott Wave Theory, created by Ralph Nelson Elliott in the 1930s, is a type of technical analysis used by traders to study financial market cycles and predict market trends. Elliott noticed that market prices move in specific patterns, which he called “waves.”

Core Principles and Patterns

The Elliott Wave Theory says market prices move in waves. There are two main types: impulse waves and corrective waves. Impulse waves go with the main trend, while corrective waves go against it. This wave pattern helps analysts guess where the market might go next by figuring out where it is in the wave cycle.

Intersection of Machine Learning and Elliott Wave Theory

Potential Synergies

Using machine Learning with Elliott Wave Theory can make market predictions more accurate. ML algorithms can handle large amounts of historical market data to find patterns and trends that match Elliott Wave structures. This mix can help traders create stronger strategies by using both methods’ predictive abilities.

Purpose and Scope of the Article

We’ll discuss both machine learning and Elliott wave theory, showing what each does well and how they can work together. Our goal is to give you a clear picture of how combining these methods can make financial market analysis and forecasting better.

Machine Learning: Fundamentals

Types of Machine Learning

Supervised Learning

Supervised learning means training a model on labeled data, where input-output pairs are known. The model learns from these examples to understand how inputs relate to outputs. Popular algorithms for this include linear regression, logistic regression, and support vector machines.

Unsupervised Learning

In unsupervised learning, the model is trained on unlabeled data. The aim is to find hidden patterns or structures in the data. Clustering and dimensionality reduction are common tasks in unsupervised learning, using algorithms like K-means and principal component analysis (PCA).

Reinforcement Learning

Reinforcement learning trains a model to make decisions by rewarding or penalizing its actions based on outcomes. It’s handy in situations where decisions need to be made step by step, like in trading algorithms or playing games.

Key Algorithms and Techniques

Neural Networks

Neural networks are machine learning algorithms inspired by the human brain’s structure. They’re made up of layers of interconnected nodes called neurons, which process and transform input data. Deep learning, a type of neural network, adds multiple hidden layers to handle complex patterns and relationships.

Support Vector Machines

Support Vector Machines (SVM) are models in supervised learning. They classify data by finding the best hyperplane to separate different groups. SVMs work well in spaces with many dimensions and can be used for classification and regression tasks.

Decision Trees

Decision Trees are simple models that divide data into branches based on feature values to make decisions. They’re used for classification and regression and form the basis of more advanced methods like random forests and gradient-boosting machines.

Applications of Machine Learning

Industry Use Cases

Machine Learning is used in various industries, including:

- Healthcare: Predicting disease outbreaks, diagnosing conditions, and personalizing treatment plans.

- Retail: Improving customer recommendations, managing inventory, and streamlining supply chains.

- Finance: Detecting fraud, scoring credit, algorithmic trading, and managing risks

Financial Markets

In financial markets, ML algorithms look at past data to find patterns, guess price changes, and create trading plans. These models can handle big datasets quickly, giving traders and investors an advantage.

Elliott Wave Theory: An In-Depth Look

Wave Patterns and Structures

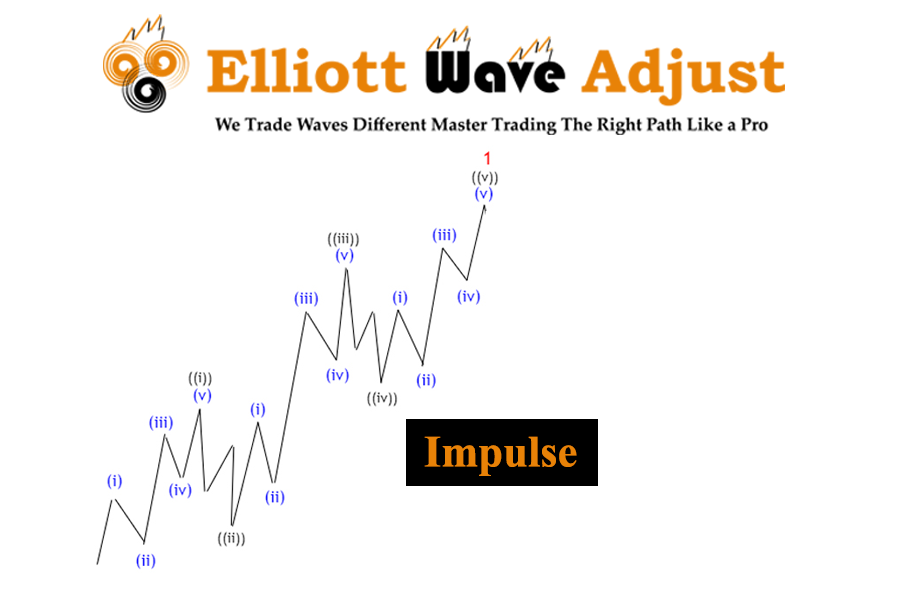

Impulse Waves

Impulse waves have five smaller waves that go with the main trend. They show strong price movements and split into even smaller patterns following the same rules.

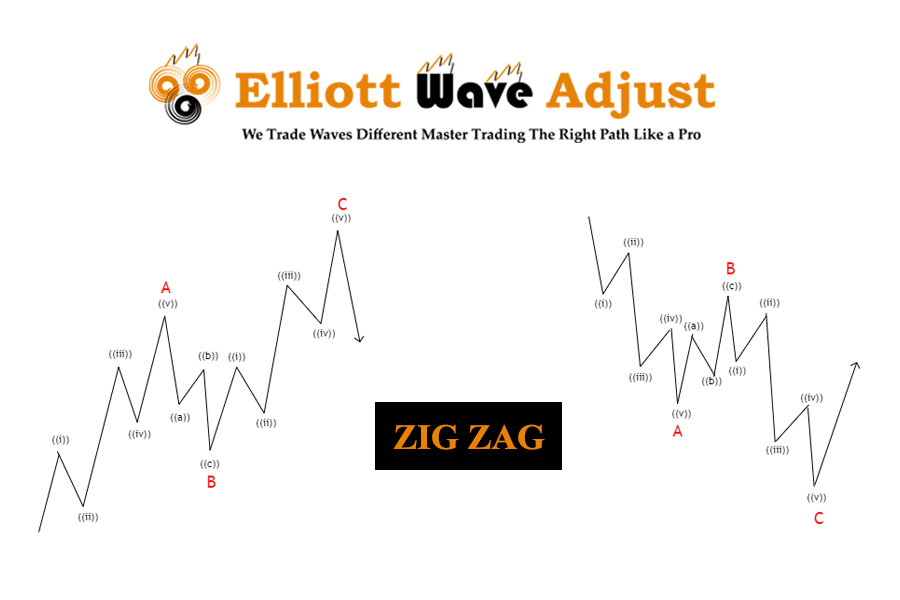

Corrective Waves

Corrective waves have three smaller waves that go against the main trend. Usually, they reverse part of the impulse wave’s movement, giving traders chances to enter or leave positions.

Rules and Guidelines

Elliott Wave Theory follows specific rules:

- Wave 2 cannot retrace more than 100% of Wave 1.

- Wave 3 cannot be the shortest of the three impulse waves (Waves 1, 3, and 5).

- Wave 4 cannot overlap the price territory of Wave 1.

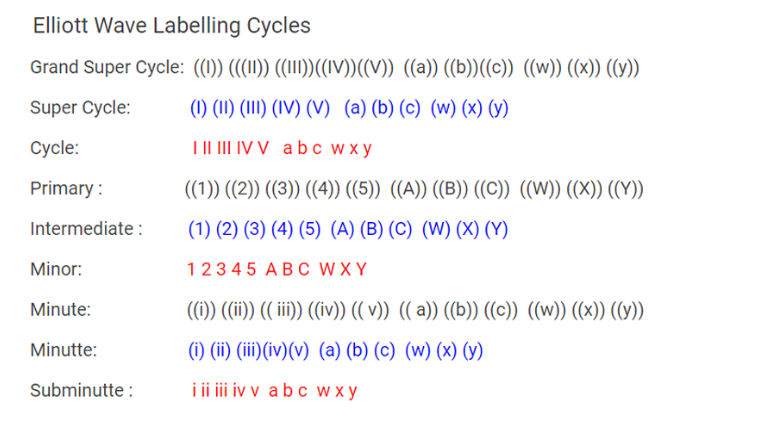

Wave Degree

Elliott Wave Theory divides waves into degrees, from tiny sub-waves to big supercycles. This setup helps analysts figure out where a wave fits in the overall market cycle.

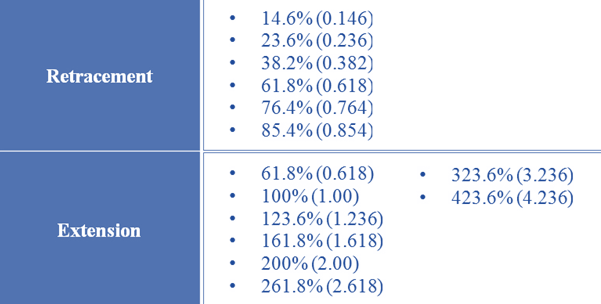

Wave Relationships

Wave relationships often follow Fibonacci ratios. Common levels are 38.2%, 50%, and 61.8%. These ratios help guess how many corrective waves might go back and find spots where they might turn around.

Application in Financial Markets

Stock Market Analysis

Elliott Wave Theory is also applicable to forex and commodities markets. Understanding wave structures in these markets allows traders to forecast currency pair movements and commodity price trends, leading to more informed trading decisions.

Forex and Commodities

Elliott Wave Theory works for forex and commodities markets too. If traders know wave patterns in these markets, they can guess where currency pairs might go and how commodity prices might change. This helps them decide how to trade more wisely.

Integrating Machine Learning with Elliott Wave Theory

Mixing machine learning (ML) with Elliott wave theory (EWT) changes how we analyze financial markets. By putting together ML’s computing strength with EWT’s patterns, traders and analysts can make better trading plans. This article looks at how to combine these methods, with examples and ideas for what’s ahead.

Data Collection and Preprocessing

Sourcing Market Data

To mix ML with EWT, start by getting good market data. This means historical prices, volume information, and other useful financial signs. You can get this data from trusted sources like financial data providers, stock markets, and financial service APIs.

Data Cleaning and Normalization

Market data is often messy, with mistakes, gaps, and mix-ups. Cleaning it means fixing errors and filling in missing bits. Normalizing it means putting it in a standard range, so no one part has too much say in the model.

Feature Engineering

Identifying Relevant Features

Feature engineering boosts how well ML models predict things. Finding the right features means picking data bits that really affect market moves. These could be past prices, trade volumes, or big economic signs.

Creating Technical Indicators

Technical indicators are math formulas using past price, volume, or interest data. Common ones are Moving Averages (MA), Relative Strength Index (RSI), Bollinger Bands, and Fibonacci levels. They show market trends and patterns that match Elliott waves.

Model Selection and Training

Choosing the Right Algorithms

Picking the right ML algorithms is important. In financial market analysis, people often use:

- Neural networks are good for finding tricky patterns and connections in data.

- Support Vector Machines (SVM): Handy for classifying things and spotting trend changes.

- Decision Trees and Random Forests: Useful for picking out important features and figuring out how important they are.

Training the Model with Market Data

After picking features and preparing the data, the next step is training the model. This means giving the cleaned and normalized data to the chosen algorithm. The model learns from past market data to guess what prices might do next based on patterns it finds.

Model Validation and Testing

Backtesting Strategies

Backtesting means trying out the trained model on past data to see how well it works. This is important for checking if the model is good and improving trading plans. By pretending to trade with old data, analysts can see how the model might have performed in real markets.

Performance Metrics

Important measurements for checking ML models in financial markets are:

- Accuracy: How many right guesses there are compared to all guesses?

- Precision and Recall: Shows how well the model spots good and bad trends.

- Sharpe Ratio: It checks how much return you get compared to the risk, which is helpful for comparing trading plans.

Case Studies and Practical Applications

Successful Integrations

Case Study 1: Predicting Stock Market Movements

In this example, we used a mix of ML and EWT to guess stock market moves. We put together old stock prices with Elliott Wave shapes and tech signs. The model figured out the wave shapes and guessed future prices well, so traders could make wise decisions.

Case Study 2: Enhancing Forex Trading Strategies

This example used a mix of ML and EWT to make forex trades better. By studying currency pair data and adding wave theory, the model gave clearer times to start and stop. Traders who used this mix made more money and took less risk.

Challenges and Limitations

Data Quality Issues

Good data is key to getting predictions right. Problems like missing bits, wrong information, and mix-ups can really mess up how well the model works. You need to keep an eye on the data and fix any issues to keep it reliable.

Overfitting and Model Robustness

Overfitting happens when a model works great on training data but not on new data. Making sure the model is strong means checking it often, trying it on different data, and using tricks like cross-validation to stop overfitting.

Future Prospects

Innovations in Algorithmic Trading

Potential for New Market Insights

Combining ML and EWT helps find new market ideas. Smart algorithms can find secret patterns in market data, helping traders understand markets better and maybe find new ways to invest.

Tools and Technologies

Software and Platforms

Mixing ML with EWT needs strong software and platforms that can deal with tough data jobs.

Popular Machine Learning Frameworks

Here are some popular ML frameworks:

- TensorFlow: Made by Google for ML and open to all.

- Keras is a Python tool for neural networks that works with TensorFlow.

- Scikit-Learn is a Python library for easy data mining and analysis.

- PyTorch is an ML library from Facebook’s AI Research Lab that’s open to all.

Trading Platforms with Machine Learning Integration

Many trading platforms help with ML, so traders can make smart algorithms. Some examples are:

- MetaTrader is known for lots of tech analysis tools and auto trading.

- QuantConnect is an open-source platform for trading algorithms, with data and tools for testing and real trades.

Programming Languages

Python for Machine Learning

Python is the top pick for ML because it’s easy, has lots of libraries, and has a big community. Libraries like TensorFlow, Keras, and Scikit-Learn all use Python, so most ML folks use it.

R for Statistical Analysis

R is a strong language, mainly for statistics and making data pictures. It’s great for looking at tricky data sets and making detailed graphs.

Libraries and Resources

TensorFlow and Keras

TensorFlow and Keras are important for making and teaching deep learning models. TensorFlow has lots of tools and stuff from the community to help researchers and developers make and use ML apps.

Scikit-Learn and PyTorch

Scikit-Learn has easy tools for digging into data, and PyTorch is great for deep learning research and development because it’s good at handling complex stuff and using memory well.

Ethical Considerations and Best Practices

Ethical Implications in Financial Markets

Using ML and AI in financial markets brings up worries about being fair and responsible with technology.

Market Manipulation Concerns

A big worry is market manipulation. Fancy algorithms might mess with market problems in ways that hurt other people in the market.

Transparency and Accountability

It’s really important for ML models and trading algorithms to be clear. Traders and developers need to make sure their models make sense and that they can explain and defend their decisions.

Developing Responsible AI Systems

Ensuring Fairness and Bias Mitigation

Making fair and unbiased AI systems is key. This means checking models often for biases and training them on all kinds of data that represents everyone.

Regulatory Compliance

Following the rules is super important. Financial firms need to make sure their use of ML and AI follows all the right laws and rules to avoid legal trouble and keep the market fair.

Conclusion

Summary of Key Points

The integration of Machine Learning with Elliott Wave Theory offers a powerful approach to financial market analysis. By leveraging the strengths of both methodologies, traders can develop more accurate and robust trading strategies.

Recap of Machine Learning and Elliott Wave Theory

Machine Learning excels at identifying complex patterns in large datasets, while Elliott Wave Theory provides a structured approach to predicting market movements based on wave patterns. Combining these fields allows for a more comprehensive analysis of financial markets.

Benefits of Integrating Both Fields

The synergy between ML and EWT enhances market prediction accuracy, reduces risks, and uncovers new trading opportunities. This integration enables traders to make data-driven decisions and develop sophisticated trading algorithms.

Final Thoughts

The Future of Financial Market Analysis

As technology continues to advance, the integration of ML and EWT is expected to play an increasingly vital role in financial market analysis. Innovations in deep learning and algorithmic trading will further enhance the predictive capabilities and adaptability of trading models.

Encouragement for Further Research

The potential for integrating ML with EWT is vast and largely untapped. Continued research and development in this area can lead to groundbreaking advancements in market analysis and trading strategies.

FAQs

What is the basic premise of Elliott Wave Theory?

Elliott Wave Theory posits that financial markets move in predictable patterns, known as waves, which are driven by investor psychology. These waves can be used to forecast future market movements.

How can machine learning improve wave pattern recognition?

Machine learning algorithms can analyze large datasets to identify and learn from complex patterns, improving the accuracy of wave pattern recognition and enabling more precise market predictions.

What are the main challenges in integrating machine learning with Elliott Wave Theory?

The main challenges include ensuring high-quality data, preventing overfitting, maintaining model robustness, and addressing ethical and regulatory concerns in financial markets.

Which machine learning algorithms are most effective for market prediction?

Effective algorithms for market prediction include neural networks, support vector machines, decision trees, and random forests. These algorithms can handle complex patterns and large datasets.

How do ethical considerations impact the use of AI in financial markets?

Ethical considerations are critical to ensuring the fair and responsible use of AI in financial markets. Issues such as market manipulation, transparency, accountability, fairness, and regulatory compliance must be addressed to maintain market integrity and protect investors.