Economic Calendar Real-time updates

Real-Time Financial Events and Indicators

Economic Calendar

Stay informed about important financial events and data releases with our Economic Calendar. This tool helps you track key economic events that can impact global markets, giving you the information you need to make smart decisions.

Key Features:

Event Listings:

- See upcoming economic events and data releases from around the world.

Date and time:

- Find the exact date and time for each event, adjusted for your time zone.

Event Details:

- Get detailed information about each event, including previous data, forecasted figures, and actual results when released.

Filter Options:

- Customize your view by filtering events by country, impact level, and type of event.

Notifications:

- Set up alerts to be notified of upcoming events and data releases.

Why Use the Economic Calendar?

- Market Insights:

- Stay informed about key economic indicators that affect global markets.

- Trading Strategy:

- Plan your trades around major economic events to seize opportunities and manage risks.

- Investment Decisions:

- Use economic data to guide your investment strategies and manage your portfolio.

- Economic Analysis:

- Understand economic trends and their potential impact on financial markets.

Sample Events:

- GDP Releases:

- Track reports on gross domestic product (GDP) from major economies to gauge economic growth.

- Inflation Data:

- Monitor consumer price index (CPI) and producer price index (PPI) releases to stay updated on inflation trends.

- Employment Reports:

- Follow Non-Farm Payroll (NFP) and unemployment rate announcements to understand labor market conditions.

- Central Bank Meetings:

- Keep an eye on interest rate decisions and policy statements from central banks.

Use our economic calendar to keep track of crucial economic events and make better financial decisions. Whether you’re a trader, investor, or financial analyst, this tool is essential for staying ahead in the financial world.

Which Currency Pairs Are Best for Elliott Wave Traders in 2024?

In 2024, Elliott Wave Theory will remain a pivotal tool for traders navigating the complexities of financial markets. For forex traders, understanding the optimal currency pairs can significantly enhance their

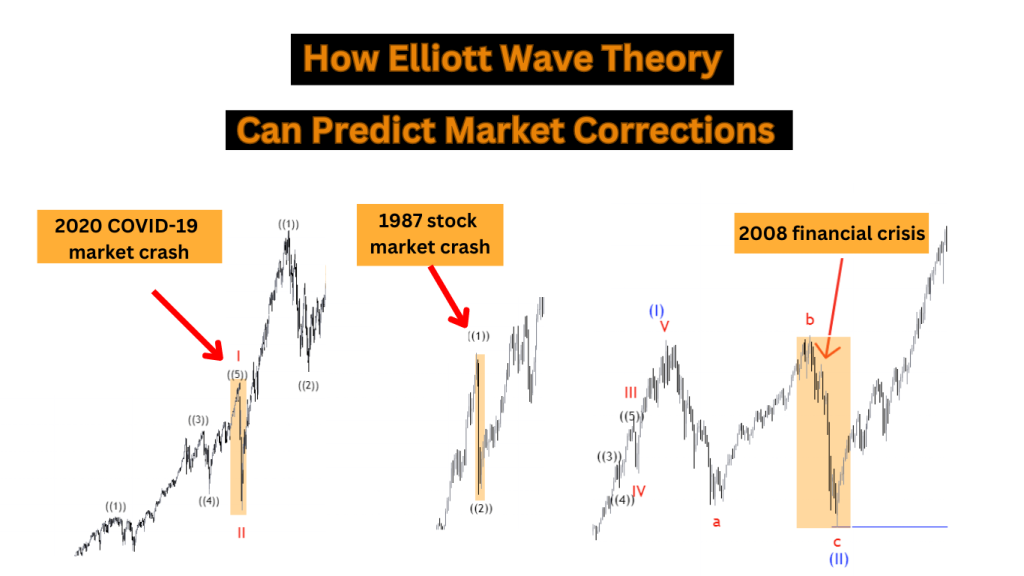

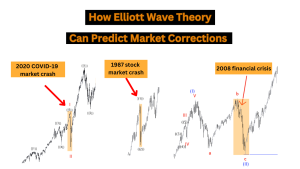

How Elliott Wave Theory Can Predict Market Corrections

Elliott Wave Theory is a powerful tool that traders and investors use to forecast market movements with great accuracy. In the financial markets, predicting market corrections is crucial for maximizing

Machine Learning and Elliott Wave Theory: A New Frontier

In the constantly changing world of financial analysis, Machine Learning (ML) and Elliott wave theory (EWT) are becoming essential tools. Combining these two methods could transform market forecasting, providing exceptional

Top 10 Common Mistakes in Elliott Wave Analysis You MUST Avoid!

Elliott wave analysis is a crucial part of technical analysis. It helps traders and investors understand market trends and potential price changes. Essentially, it says that market prices follow specific

From Novice to Pro: The Ultimate Guide to Cryptocurrency Trading

Cryptocurrency trading has become more than just a trend; It is a global phenomenon that has attracted the attention of both experienced investors and newcomers alike. In this comprehensive guide,

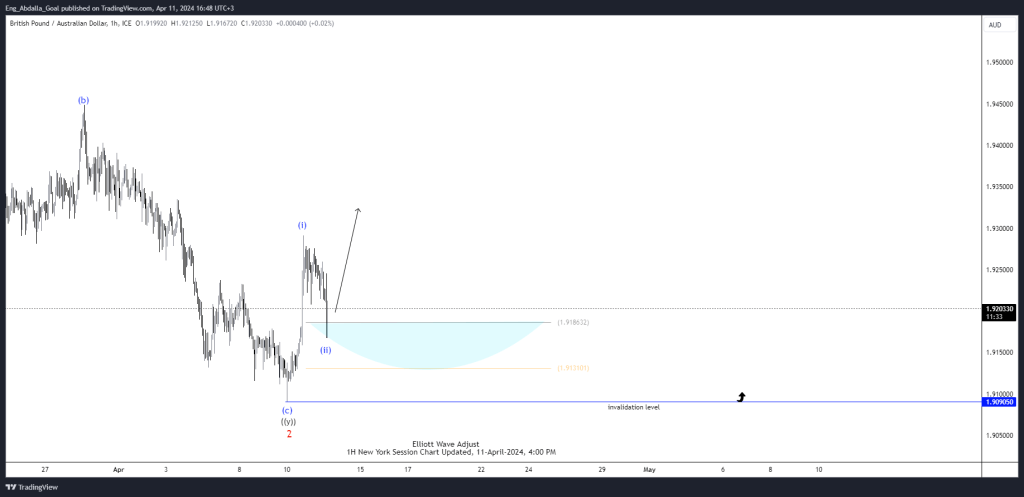

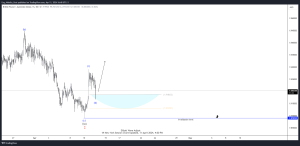

GBPAUD Elliott Wave View: Buyers have taken control after completing the Double-Three Structur

In this technical article we’re going to take a quick look at the Elliott Wave charts of GBPAUD published in members area of the website. Our team recommended members to