Crytocurrency

TRUSTED CRYPTOCURRENCY FORECAST

Premium Package Elliott Wave Adjust BTC, ETH and LTC

We regularly cover Bitcoin, Ethereum and Litecoin inside members area on a daily basis, if you would like to access Elliott wave adjust and Trading Signals for these 3 Crypto-currencies,

Some believe this is a new form of money, while others think it’s just a buzzword.

However, there is more to this story.

What is Cryptocurrency and How Does It Operate?

Cryptocurrency is any form of currency that exists digitally or virtually and that uses encryption to secure transactions.

is the currency of Cryptocurrencies have no central issuing or regulating authority and use a decentralized system to record transactions and issue new units.

Cryptocurrency operates as a digital payment system independent of banks for transaction verification.

It functions as a peer-to-peer system, enabling individuals from any location to send and receive payments seamlessly.

Cryptocurrency payments are simply digital entries in an online database that describe a specific transaction, rather than physical money carried around and exchanged in the real world.

The act of transferring cryptocurrency funds results in the recording of the transaction on a public ledger.

Cryptocurrencies are stored in digital wallets.

The term “cryptocurrency” is derived from the utilization of encryption to authenticate transactions.

This means that sophisticated coding is required when storing cryptocurrency data between wallets or sending it to a public ledger.

Encryption is designed to offer security and safeguarding.

Bitcoin, established in 2009, stands as the pioneering cryptocurrency and continues to be the most widely recognized one in the present day.

Much of the interest in cryptocurrencies is trading for profit, and speculators can sometimes drive up prices.

How Does It Operate?

What is blockchain?

Ripple:

How to Buy Cryptocurrency

Step 1: Choose a Platform

The initial stage involves selecting the platform you wish to utilize.

- Traditional Brokers:These are online brokers that offer the opportunity to buy and sell not only cryptocurrencies, but also other financial assets such as stocks, bonds, and ETFs.These platforms have lower transaction costs but tend to have fewer cryptographic features.

- Crypto currency exchanges:There are many crypto exchanges to choose from, each offering different cryptocurrencies, wallet storage, interest-bearing account options, and more.Many exchanges charge asset-based fees.When comparing different platforms, consider what cryptocurrencies they offer, what fees they charge, what security features they have, and what storage and withdrawal options they have.Consider what educational resources are available.

- Bitcoin Trust: You can use your regular brokerage account to buy shares in a Bitcoin Trust, These instruments allow individual investors to access cryptocurrencies through the stock market.

- Bitcoin Investment Trust: Choose between Bitcoin ETF and Bitcoin Investment Trust.

- Blockchain Stocks or ETFs: Investing indirectly in cryptocurrencies is possible through blockchain-focused companies or ETFs. Another approach is to acquire stocks and ETFs from entities leveraging blockchain technology.

How to Safely Store Cryptocurrency

Securing your cryptocurrency after purchase is crucial to safeguard it from potential hacks or theft. The common practice involves using crypto wallets, which can be physical devices or online software designed to securely store the private keys associated with your digital assets. While some exchanges offer wallet services, not all automatically provide this option.

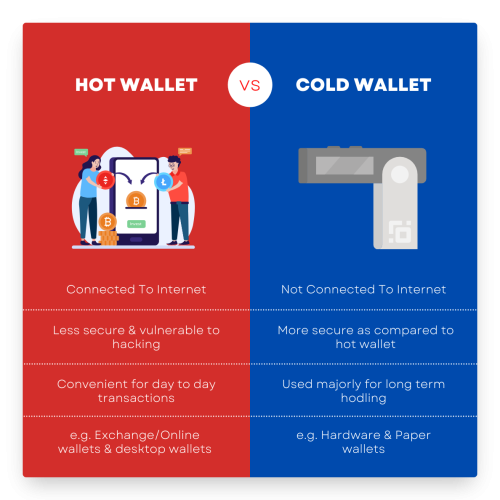

There are various wallet providers, each falling into the categories of “hot wallet” or “cold wallet”:

- Hot Wallet Storage: Hot wallets utilize online software to safeguard the private keys associated with your digital assets.

- Cold Wallet Storage: Also known as hardware wallets, cold wallets rely on offline electronic devices to securely store your private keys.

It’s important to note that cold wallets may come with fees, unlike hot wallets, which typically do not charge for their services.”

“What Purchases Can You Make with Cryptocurrency?

Initially envisioned as a medium for everyday transactions, Bitcoin aimed to facilitate buying anything from small items like coffee to more significant purchases like computers or even real estate. However, this widespread adoption hasn’t fully materialized, and while the acceptance of cryptocurrencies by institutions is increasing, large transactions remain relatively rare. Nevertheless, various products can be bought through e-commerce websites using crypto. Here are some illustrative examples:

Technology and E-commerce Sites: Notable tech retailers like newegg.com, AT&T, and Microsoft accept cryptocurrency on their platforms.Overstock, an early adopter, was among the first e-commerce sites to embrace Bitcoin.Other major players like Shopify, Rakuten, and Home Depot also facilitate transactions with cryptocurrencies.

Luxury Goods: Certain luxury retailers, such as Bit dials, offer high-end watches like Rolex and Patek Philippe in exchange for Bitcoin.

Cars: From mass-market brands to high-end luxury dealers, some car dealerships already accept cryptocurrency as a valid form of payment.

Insurance: Swiss insurer AXA, starting in April 2021, began accepting Bitcoin for all its insurance lines, excluding life insurance due to regulatory constraints, Premier Shield Insurance in the United States, specializing in home and auto insurance coverage, welcomes Bitcoin as a form of payment for premiums.

For those looking to spend cryptocurrency at retailers that don’t directly accept it, the option of using a cryptocurrency debit card, such as Bit Pay in the US, provides a workaround.”

Cryptocurrency fraud and cryptocurrency scams

Cryptocurrency fraud and scams are unfortunately on the rise, encompassing various deceptive tactics:

- Counterfeit Websites: Fraudulent online platforms employ fabricated testimonials and crypto terminology, enticing investors with promises of substantial, guaranteed returns upon continuous investment.

- Virtual Ponzi Schemes: Perpetrators of cryptocurrency crimes present fictitious investment opportunities, creating the illusion of significant profits by using new investors’ funds to pay off old investors. Notably, the Bit Club Network scam amassed over $700 million before its organizers faced indictment in December 2019.

- False “Celebrity” Endorsements: Scammers impersonate billionaires or well-known personalities online, luring individuals with promises to multiply their virtual currency investments. By spreading rumors in messaging apps or chat rooms about a famous figure endorsing a specific cryptocurrency, scammers drive up its price, only to sell their stake and cause a subsequent decrease in value.

- Romance Scams: Exploiting online dating platforms, fraudsters convince individuals they meet to invest or trade in virtual currencies. The FBI reported a surge in crypto-focused romance scams, with over 1,800 cases and losses amounting to $133 million in the first seven months of 2021.

Additionally, criminals may masquerade as legitimate virtual currency traders or establish fraudulent exchanges to dupe people into handing over money. Another scheme involves deceptive sales pitches for individual retirement accounts in cryptocurrencies. Finally, straightforward cryptocurrency hacking occurs when criminals infiltrate digital wallets storing virtual currency to illicitly obtain it.

Is the safety of cryptocurrency guaranteed?

Cryptocurrencies typically rely on blockchain technology, where transactions are recorded in “blocks” and timestamped. Although the process is intricate, it results in a digital ledger of cryptocurrency transactions that’s highly resistant to tampering by hackers.

To enhance security, transactions often involve a two-factor authentication process. This might include entering a username and password to initiate a transaction, followed by inputting an authentication code sent via text to a personal cell phone.

Even with these security measures in place, cryptocurrencies are not impervious to hacking. Some significant breaches have hit cryptocurrency start-ups hard, with Coincheck losing $534 million and BitGrail losing $195 million, ranking among the largest cryptocurrency hacks in 2018.

Unlike traditional currencies backed by governments, virtual currencies derive their value solely from supply and demand. This dynamic can lead to substantial gains or losses, as cryptocurrency investments are susceptible to drastic market fluctuations. Additionally, regulatory safeguards for cryptocurrency investments are considerably less than those in place for traditional financial products such as stocks, bonds, and mutual funds.

What is Cryptography?

Cryptography serves as a method for safeguarding information and communication by employing codes, ensuring that only designated recipients can comprehend and process the messages. The term “crypt” signifies hidden, while “graphy” refers to writing, and individuals proficient in this practice are known as cryptographers.

Modern cryptography adheres to four primary standards:

Confidentiality: Ensures that only the intended recipient can grasp the information.

Integrity: Prevents unauthorized alterations to stored information, with any changes being readily detectable.

Repudiation: Ensures that the originator of the information cannot deny their involvement in its creation and transmission.

Authentication: Enables both the sender and receiver to confirm each other’s identity and validate the origin or destination of the information.

Cryptography techniques, rooted in mathematical concepts, utilize algorithms or rule-based calculations to transmit messages in a manner that resists easy interpretation. These algorithms generate cryptographic keys that govern digital signing and verification, safeguarding data privacy, internet browsing, and confidential communications, including emails and credit card transactions.

Modern cryptography commonly involves translating plain text, readable content, into encrypted, unreadable cipher text, and then decrypting it back to plain text.

Cryptography is categorized into two main types:

Single Key Encryption Algorithms (Symmetric): These algorithms utilize a fixed-length block cipher and a secret key for both sender encryption and receiver decryption.

Public Key Encryption Algorithms (Asymmetric): This category involves a pair of keys—a public key for encrypting messages linked to the sender and a private key, exclusively known to the originator, for decrypting information.

A cryptosystem, defined by a comprehensive set of standards adhered to by a specific procedure or protocol, encompasses these encryption methodologies.