Position Size Calculator

Position Size Calculator

Our Position Size Calculator helps you determine the appropriate position size in trading based on your risk tolerance, account equity, and stop loss level. This tool is essential for managing risk and ensuring consistency in your trading strategy.

Key Inputs:

- Account Equity: Enter the total equity of your trading account. For example, $100,000.

- Risk Percentage: Specify the percentage of your account equity that you are willing to risk on a single trade. For example, 1%.

- Stop Loss (in pips or price): Define your stop loss level either in pips (for forex) or price points relevant to your trading instrument.

Calculated Results:

- Recommended Lot Size: The optimal lot size to trade is calculated based on your inputs.

- Units: For forex trading, this represents the number of currency units to buy or sell.

- Dollar Risk: The amount of money at risk based on your account equity and risk percentage.

Usage Tips:

- Risk Management: Adjust your position size to align with your risk management strategy.

- Trade Planning: Calculate position sizes before entering trades to ensure consistency.

- Account Protection: Limit losses and protect your account from significant drawdowns.

How to use:

- Enter Inputs: Input your account equity, desired risk percentage (e.g., 1%), and stop loss level.

- Calculate: Click ‘Calculate’ to determine the recommended lot size, units, and dollar risk.

- Adjust: fine-tune your position size based on your risk tolerance and trading goals.

Benefits:

- Precision: calculates position size based on specific risk parameters.

- Consistency: It helps maintain consistent risk across different trades.

- Efficiency: Streamlines trade planning and risk management processes.

Example:

Account Equity: $100,000

Risk Percentage: 1%

Stop Loss: 50 pips

Result:

- Recommended Lot Size: 2 standard lots (or 200,000 units for forex trading)

- Dollar Risk: $1,000 (1% of $100,000)

Use our Position Size Calculator to optimize your trading decisions and manage risk effectively. Ensure each trade aligns with your risk management plan for sustainable trading success.

Which Currency Pairs Are Best for Elliott Wave Traders in 2024?

In 2024, Elliott Wave Theory will remain a pivotal tool for traders navigating the complexities of financial markets. For forex traders, understanding the optimal currency pairs can significantly enhance their

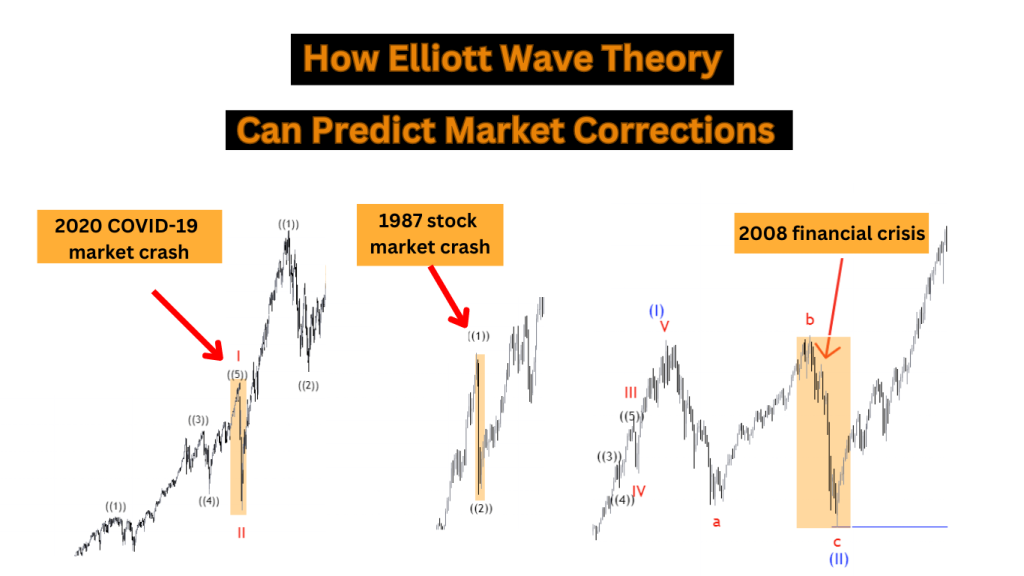

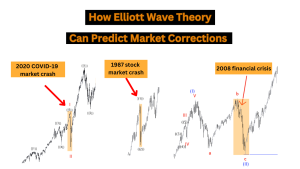

How Elliott Wave Theory Can Predict Market Corrections

Elliott Wave Theory is a powerful tool that traders and investors use to forecast market movements with great accuracy. In the financial markets, predicting market corrections is crucial for maximizing

Machine Learning and Elliott Wave Theory: A New Frontier

In the constantly changing world of financial analysis, Machine Learning (ML) and Elliott wave theory (EWT) are becoming essential tools. Combining these two methods could transform market forecasting, providing exceptional

Top 10 Common Mistakes in Elliott Wave Analysis You MUST Avoid!

Elliott wave analysis is a crucial part of technical analysis. It helps traders and investors understand market trends and potential price changes. Essentially, it says that market prices follow specific

From Novice to Pro: The Ultimate Guide to Cryptocurrency Trading

Cryptocurrency trading has become more than just a trend; It is a global phenomenon that has attracted the attention of both experienced investors and newcomers alike. In this comprehensive guide,

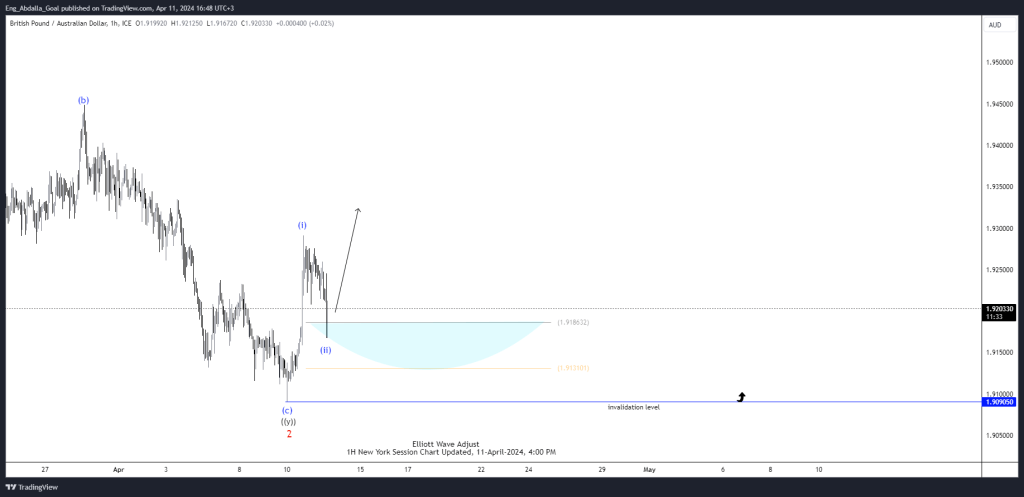

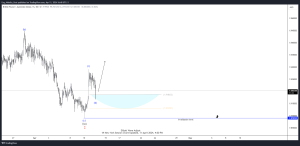

GBPAUD Elliott Wave View: Buyers have taken control after completing the Double-Three Structur

In this technical article we’re going to take a quick look at the Elliott Wave charts of GBPAUD published in members area of the website. Our team recommended members to