In this technical article we’re going to take a quick look at the Elliott Wave charts of GBPAUD published in members area of the website. Our team recommended members to avoid Selling , while keep favoring the upside in the pair. Recently we got recovery that reached our buying zone. The pair found buyers and made reaction from the Extreme area as expected. In the further text we are going to explain the Elliott Wave Adjust and trading strategy.

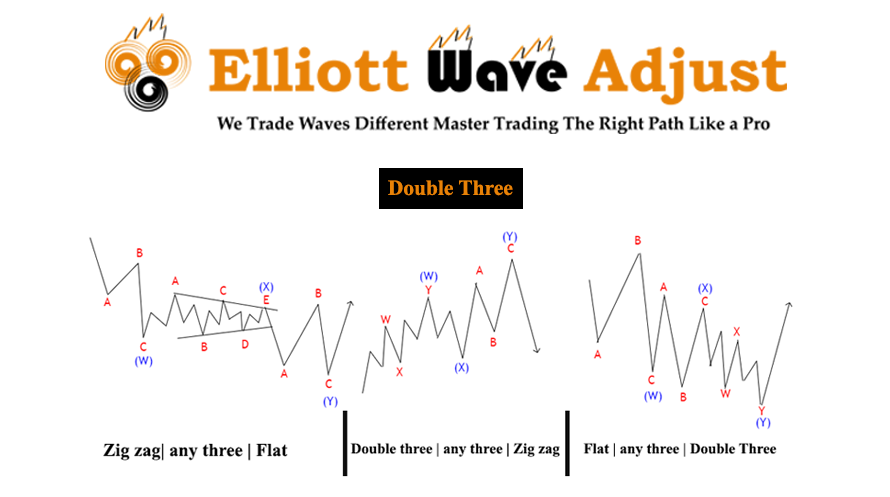

Before we take a look at the real market example, let’s explain Elliott Wave Double Three pattern.

Elliott Wave Double Three Pattern

Double three is the common pattern in the market , also known as 7 swing structure. It’s a reliable pattern which is giving us good trading entries with clearly defined invalidation levels.

The picture below presents what Elliott Wave Double Three pattern looks like. It has (W),(X),(Y) labeling and 3,3,3 inner structure, which means all of these 3 legs are corrective sequences. Each (W) and (Y) are made of 3 swings , they’re having A,B,C structure in lower degree, or alternatively they can have W,X,Y labeling.

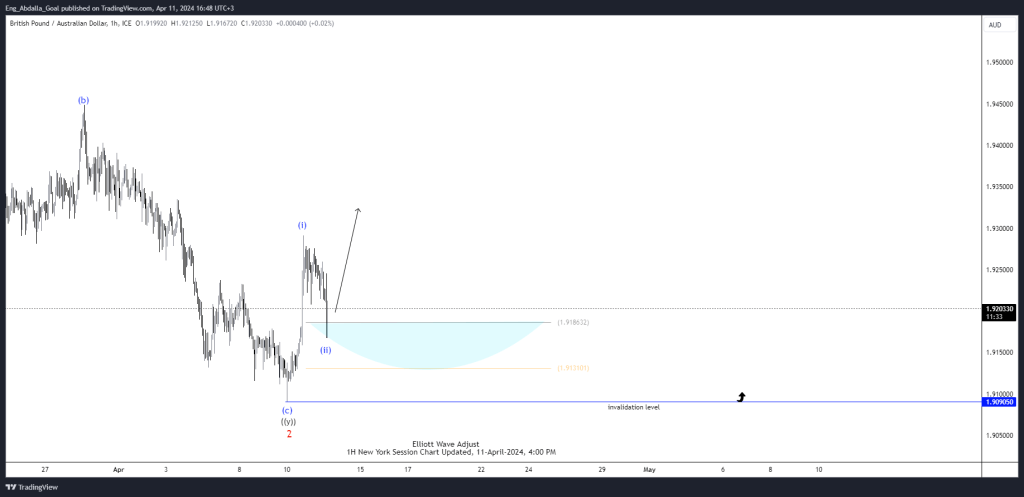

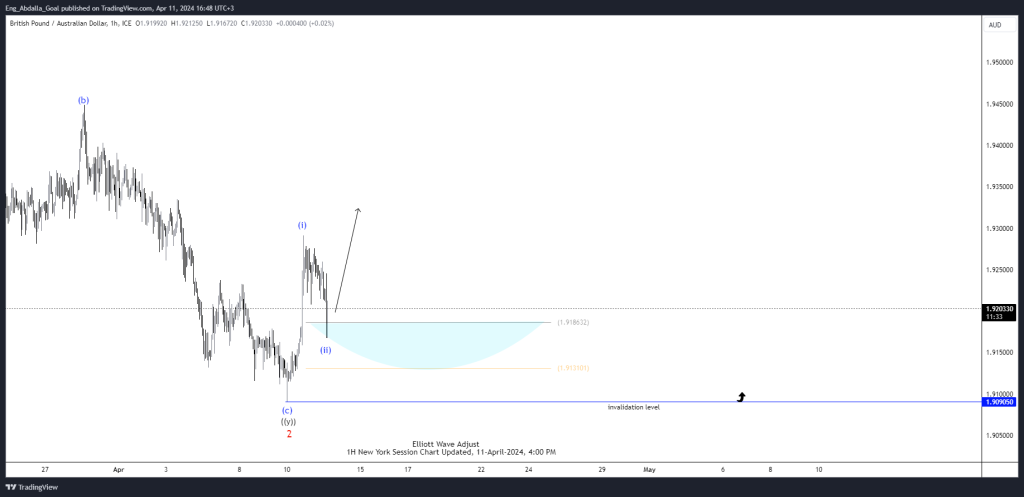

GBPAUD 4 Hour Elliott Wave Analysis April 10, 2024

The pair is correcting the cycle from the 1.856700 low to the 1.957060 peak , then the pair began to move down side to correct the cycle giving us 2 red recovery. after that we got 7 swing move to the downside wave ((w)) ended at 1.927780, wave ((x)) ended at 1.951000, and Wave ((y)) ended 1.909000. so The price has already reached the extreme zone at 1.918686-1.898826 (Undivided Zone– Buyers zone).

Buyers appeared at the marked extreme zone and we are getting a good reaction from there. Pullback completed at the 1.90900 low. The rally from the buyer’s zone looks like 5 waves which suggests after 3 waves pull back it should ideally see further continuation higher. It’s important that 1.90900 pivot holds during the expected pullback in order to hold the presented view intact.

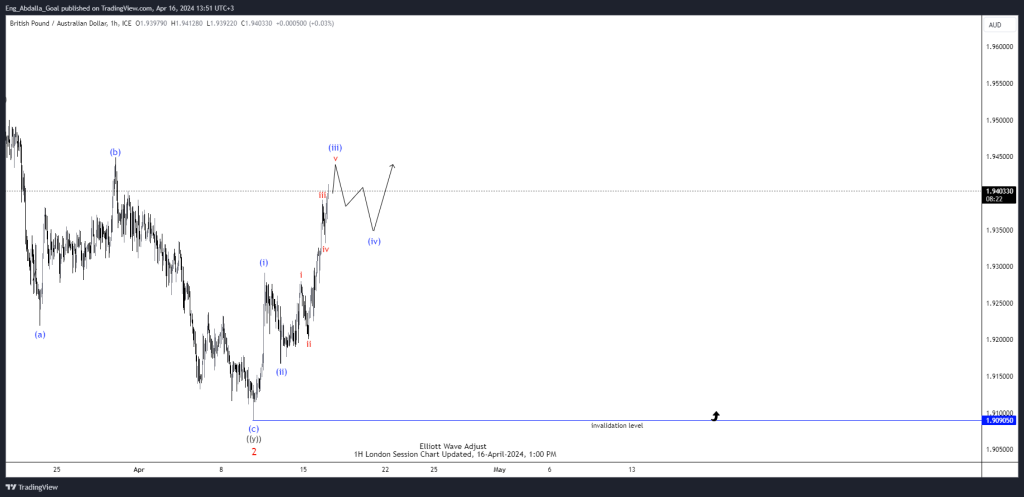

GBPAUD 1 Hour Elliott Wave Analysis April 11, 2024

So our members took these both opportunities for swing and inter-day trading.

Keep in mind that the market is dynamic and the presented view could have changed in the meantime. You can check the most recent charts in the membership area of the site. The best instruments to trade are those having incomplete bullish or bearish swing sequences. We put them in Sequence Report and the best among them are shown in the Live Trading Room.

We cover over 20+ instruments in total, but not every chart is a trading recommendation. We present Official Trading Recommendations in Live Trading Room

If you are not a member yet, Sign Up now and get access to new trading opportunities. Through time we have developed a very respectable trading strategy that defines Entry, Stop Loss and Take Profit levels with high accuracy.

Stay tuned for an in-depth analysis.