Gann indicators, explicitly the Gann point, are trading procedures created by W.D. Gann. These are generally perceived as creative and are still considered and utilized by dealers today. Gann utilized points and different mathematical designs to separate time and cost into relative parts. The Gann marker is frequently used to foresee backing and opposition regions, key ups and downs, and future cost developments.

I. Introduction

Explanation of Gann Indicators

Gann Indicators are technical analysis tools used by traders to analyze and forecast price movements in financial markets. Developed by legendary trader and financial analyst W.D. Gann, those indicators are based totally on mathematical concepts and geometric ideas.

Purpose of the Article

The purpose of this article is to provide a comprehensive know-how of Gann indicators, inclusive of their history, primary standards, and different sorts. By exploring the intricacies of Gann theory and its various applications, readers will gain insight into how these indicators can be used to enhance their buying and selling techniques and make informed funding selections.

II. Understanding Gann Indicators

Who was W.D. Gann?

W.D. Gann was a prominent trader and analyst who lived in the early 20th century. He is widely regarded as one of the most successful traders of his time, known for his pioneering work in technical analysis and market forecasting. Gann’s trading methods were based on mathematical and geometric principles, and his insights continue to influence traders and investors to this day.

Basics of Gann Theory

1. Time and Price Analysis

Gann believed that price movements in financial markets are influenced by both time and price factors. He developed various techniques to analyze the relationship between these two variables, including the use of geometric angles and mathematical ratios.

2. Geometric Angles

One of the key concepts in Gann theory is the use of geometric angles to identify potential support and resistance levels in price charts. These angles are derived from mathematical calculations based on the price and time dimensions of market movements.

3. square of Nine

The Square of Nine is a mathematical tool advanced by Gann to forecast future rate moves primarily based on beyond-rate facts. It consists of a grid of numbers arranged in a square, with each quantity representing an ability price stage. Traders use the Square of Nine to identify key rate goals and reversal factors within the market.

Types of Gann Indicators

1. Gann Angles

Gann Angles are diagonal lines drawn on price charts to represent key support and resistance levels. These angles are based on geometric principles and can help traders identify potential trend reversal points and price targets.

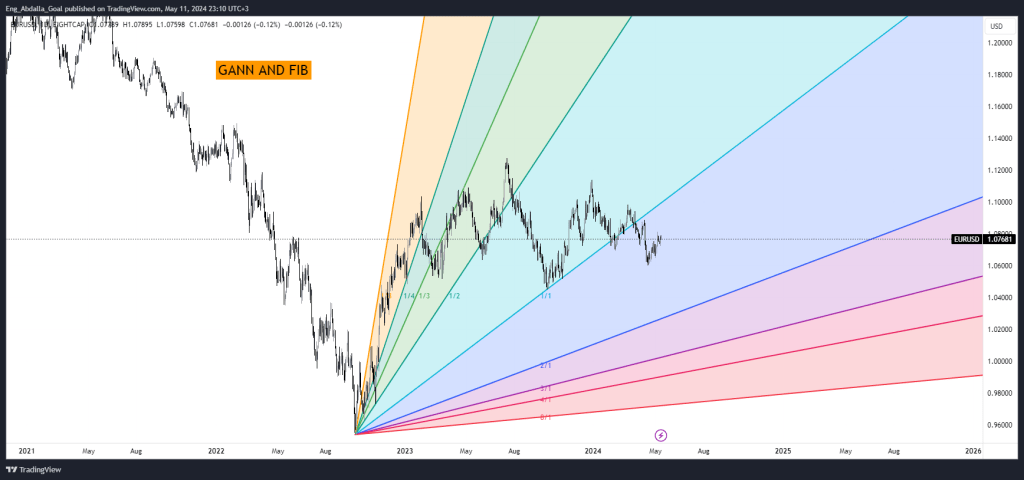

2. Gann Fans

Gann Fans are a series of trendlines drawn at different angles from a specific point on a price chart. These trendlines help traders visualize the direction and strength of market trends, as well as potential support and resistance levels.

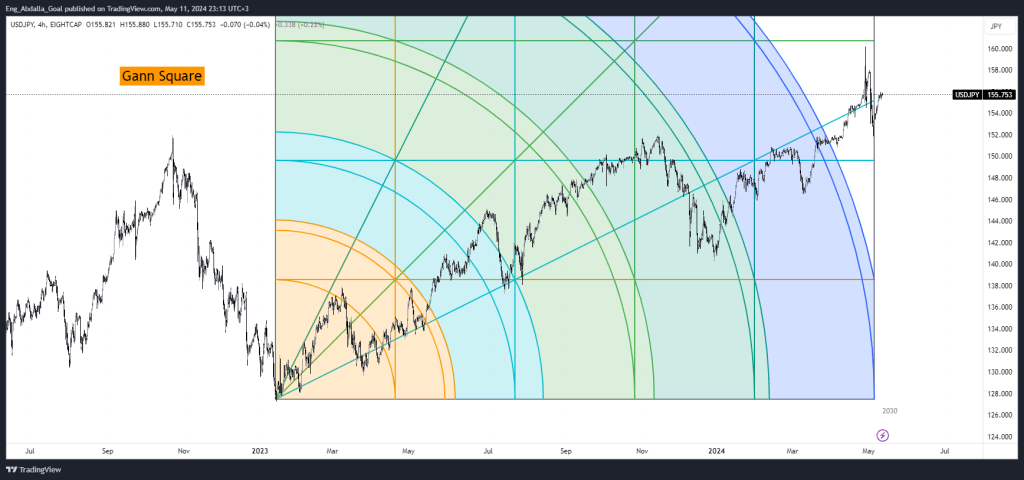

3. Gann Squares

Gann Squares are grids of numbers arranged in a square, similar to the Square of Nine. Traders use Gann Squares to identify key price levels and reversal points in the market based on mathematical calculations and geometric principles.

4. Gann Lines

Gann Lines are horizontal lines drawn on price charts to represent key support and resistance levels. These lines are based on mathematical calculations and can help traders identify potential entry and exit points in the market.

By utilizing these various types of Gann Indicators, traders can gain valuable insights into market trends, identify potential reversal points, and make more informed trading decisions.

III. How Gann Indicators Work

Principles Behind Gann Analysis

1. Law of Vibration

The Law of Vibration is a fundamental principle in Gann analysis, which states that markets are governed by natural laws and rhythms. According to this principle, price movements in financial markets follow predictable patterns and cycles, which can be analyzed and forecasted using mathematical and geometric techniques.

2. Law of Harmony

The Law of Harmony suggests that there is a natural order and symmetry in market movements, characterized by repeated cycles of expansion and contraction. Gann believed that by understanding these harmonic relationships, traders could anticipate future price movements and identify profitable trading opportunities.

Applying Gann Indicators

1. Identifying Support and Resistance Levels

Gann Indicators can help traders identify key support and resistance levels in price charts, which are crucial for making trading decisions. By analyzing geometric angles, trendlines, and price patterns, traders can pinpoint areas where buying or selling pressure is likely to emerge, allowing them to enter or exit positions more effectively.

2. Predicting Price Movements

Gann Indicators are also used to predict future price movements based on past market data and mathematical calculations. By applying Gann’s principles of time and price analysis, traders can forecast potential price targets and reversal points, helping them anticipate market trends and adjust their trading strategies accordingly.

3. Timing Market Turns

One of the primary objectives of Gann analysis is to identify market turning points or trend reversals. Gann Indicators provide traders with tools to gauge the timing of these turns, allowing them to capitalize on emerging trends and avoid potential losses. By combining Gann’s geometric angles with other technical indicators and chart patterns, traders can enhance their timing and accuracy in predicting market reversals.

C. Gann Indicator Formulas and Calculations

1. Gann Angles Calculation

Gann Angles are calculated using geometric principles and mathematical ratios derived from the Square of Nine. These angles represent the slope of potential support and resistance levels in price charts and can be drawn at various angles, such as 45 degrees or 90 degrees, depending on market conditions and trading preferences.

2. Gann Fan Construction

Gann Fans are constructed by drawing trendlines from a specific anchor point on a price chart, usually a significant high or low. These trendlines are then extended at equal intervals to create a fan-like pattern, which helps traders visualize potential support and resistance levels as well as the direction of market trends.

3. Gann Square of Nine Calculation

The Gann Square of Nine is a mathematical tool used to calculate potential price targets and reversal points in the market. It consists of a grid of numbers arranged in a square, with each number representing a specific price level. Traders use various calculations and formulas, such as adding or subtracting a fixed value from each number, to identify key price levels and forecast future price movements.

By understanding the principles behind Gann analysis and applying Gann Indicators effectively, traders can gain valuable insights into market dynamics, improve their timing and accuracy in trading, and enhance their overall profitability.

IV. Gann Indicators: What Are They, and How Would You Utilize Them?

Understanding Gann Measurements:

The Gann indicator depends on the idea that the market pivots starting with one point, then onto the next, and when one point is broken, the value moves to the next point. Different points combine to shape a Gyan fan. Gann studies have been involved by dynamic merchants for quite a long time and remain a popular strategy for examining the heading of a resource, even though the prospects and financial trades have changed essentially.

Fresher trading regions, for example, the unfamiliar trade market and the innovation of trade-traded reserves (ETFs), require a reexamination of a portion of the standards of development and application ideas. While the essential design of the Gann point is something similar, this article will make sense of why changes in value levels and unpredictability have made it important to change a few key components.

The Gann point is a popular examination and trading device used to quantify important factors like examples, cost, and time. A regularly examined subject among specialized experts is that the past, present, and future exist at the same time at the Gann point.

While breaking down or trading the course of a specific market, an investigator or broker uses that data to comprehend where the market has been beforehand, whether it is close to past lows or highs, and to foresee future cost developments.

Gann point and pattern line:

Drawing plots for trade and anticipating is likely the most famous logical device utilized by merchants among all W.D. trading methods. Gann. Many dealers draw them by hand on diagrams and, surprisingly, utilize modernized, specialized examination bundles to put them on the screen.

Since it is generally simple for the present dealers to put Gann points on outlines, many brokers want to consider when, how, and why they use Gann points. These points are frequently contrasted with pattern lines, yet many people don’t understand that they are not the same thing.

Gann’s point is a corner-to-corner line that moves at a consistent speed. Pattern lines are made by associating low costs with upturns and important expenses with downtrends. The benefit of attracting Gann points compared with pattern lines is that they move at a steady speed.

This allows examiners to foresee what the cost will be on a particular date from now on. This doesn’t imply that the Gann point generally predicts the heading of the market, yet the expert can tell where the Gann point will be, which can assist with deciding the strength and course of a pattern. Then again, even though pattern lines have some prescient worth, they are typically dependent upon intermittent changes and, thus, are not solid for making long-haul expectations.

Exceptional Contemplations:

Gann thought that the past, present, and future were completely associated with a similar impact at a specific point. All things considered, Gann points can be utilized to foresee backing and obstruction, directional strength, and the timing of ups and downs.

Backing and obstruction:

Utilizing Gann points to anticipate backing and obstruction is likely the most widely recognized use. When the investigator has decided the trading period (month to month, week after week, every day) and scaled the graph suitably, the broker essentially draws the three principal Gann points from a higher place and beneath 1X2, 1X1, and 2X1. This technique approaches the market and allows examiners to peruse market developments within this structure.

Upturn points offer help, and downtrend points give obstruction. Experts know where the point is on the graph, so they can choose whether to purchase with help or sell with opposition.

Merchants should likewise know about how the market swings, starting with one point and then onto the next. This is known as the “law of everything being equal.” The standard is that once the market goes through one point, it continues toward the next.

One more method for deciding between help and obstruction is to consolidate points and skylines. For instance, the Gann point in a downtrend frequently crosses the half-retracement level. This mix lays out a key opposing point.

The equivalent goes for upturn points over the half-level. This region will be an important help point. If you have a drawn-out diagram, you can see many points bunched at or close to a similar cost. These are called cost gatherings. The more points moved in a space, the more important the help or opposition will be.

Qualities and shortcomings:

The primary Gann points are 1X2, 1X1, and 2X1. 1X2 implies that the point moves 1 cost unit per 2 time units. 1X1 moves the cost by 1 unit in 1 unit of time. Finally, 2X1 moves the cost by 2 units in 1 unit of time. You can likewise utilize a similar equation to shape the points 1X8, 1X4, 4X1, and 8X1.

The legitimate chart scale is important for this sort of investigation. Gann believed that the market should have a rectangular relationship, so the right diagram paper and scale were important for his understanding of strategies. Since the chart was “square,” the 1X1 point is often called a 45-degree point. However, drawing points using degrees may work if the chart is appropriately scaled.

Points show backing and obstruction, yet in addition, they give examiners hints about the strength of the market. Trading at or somewhat over the 1X1 point of an upswing implies the market is adjusted.

If the market is trading at the 2X1 upturn point or somewhat over, the market is in serious areas of strength. If it is trading at or close to 1X2, it implies the pattern isn’t areas of strength for extremely. If you take a gander at the market through and through, the strengths and shortcomings of the market are switched. Anything short of 1X1 is defenseless.

Moment:

Gann points are additionally used to foresee important pinnacles, lows, and pattern inversions. This is a numerical technique known as “squaring” and is utilized to decide when time regions or market headings are probably going to change. The essential idea is to expect a shift in course when the market arrives at a unit of time and the cost increments or diminishes.

This timing indicator works best on long-haul outlines like month-to-month or week-by-week graphs. This is because everyday outlines frequently have so many farthest cutoff points, lower cutoff points, and ranges to examine. Like cost activity, these timing tools will generally work best when “packaged” with other time markers.

Gann points can be an important device for investigators and brokers when utilized accurately. By keeping a receptive outlook and figuring out the important idea that the past, present, and future exist all the while in the Gann point, you will want to examine and trade the market with more noteworthy exactness. Finding out about different market qualities, for example, unpredictability, value scales, and how the market moves inside the Gann point system, will assist you with working on your scientific abilities.

What is the best Gann indicator?

Although it is difficult to recognize the “best” marker with regards to diagram examination, the most regularly utilized Gann points are the 2X1 point, 1X1 point, and 1X2 point, which mirror the normal change in cost occasionally. Cost developments along any of these lines can be an indication of an adjustment in market sentiment.

Is the Gann examination solid?

Gann’s examination is questionable in the speculation world, and he contrasts it with monetary horoscopes. Gann was a firm devoted to soothsaying and numerology and frequently integrated otherworldliness into his business strategies. Even though he professed to have made a huge number of dollars from trading, agents later found that at the hour of his demise, his home was worth just $100,000.

How is the Gann point determined?

Gann points are determined by defining a boundary at a particular point based on important sticker costs like ups and downs. The incline of these is still up in the air by the Gann point. 1X1 (for a 45-degree point), 2X1 (for a 60-degree point), and so on.

V. Common Misconceptions About Gann Indicators

Gann Analysis as a Predictive Tool

One common misconception about Gann Indicators is that they are infallible predictive tools that can accurately forecast future price movements with certainty. While Gann analysis provides valuable insights into market dynamics and trends, it is not a crystal ball and cannot guarantee precise predictions of future price behavior. Traders should use Gann Indicators as part of a comprehensive trading strategy and combine them with other technical analysis tools and risk management techniques to make informed decisions.

Complexity of Gann Techniques

Another misconception is that Gann techniques are overly complex and difficult to understand, especially for novice traders. While Gann analysis does involve mathematical calculations and geometric principles, it can be learned and applied effectively with proper education and practice. Traders should start with the basics of Gann theory and gradually build their knowledge and skills over time, focusing on practical applications and real-world trading scenarios.

Overreliance on Gann Tools

Some traders may fall into the trap of overrelying on Gann tools and ignoring other important aspects of trading, such as fundamental analysis, market sentiment, and risk management. While Gann Indicators can provide valuable insights into market trends and price movements, they should be used in conjunction with other technical analysis tools and corroborating evidence to confirm trading signals and reduce the risk of false signals. Traders should maintain a balanced approach to trading and avoid placing undue emphasis on any single indicator or strategy.

By addressing these common misconceptions and understanding the limitations of Gann Indicators, traders can make more informed and effective use of these tools in their trading activities. It is essential to approach Gann analysis with a critical mindset, continually evaluate its effectiveness in different market conditions, and adapt trading strategies accordingly to achieve long-term success.

VI.Conclusion:

The Gann marker addresses a type of diagram examination that predicts future cost developments given mathematical lines. Although this method is dubious, Gann lines remain a famous outline investigation strategy for foreseeing future help and opposition levels.

VII. Frequently Asked Questions (FAQs)

A. What are Gann angles?

Gann angles are diagonal lines drawn on price charts to represent key support and resistance levels. These angles are based on geometric principles and mathematical ratios derived from the Square of Nine, and they help traders identify potential trend reversal points and price targets.

B. How do Gann fans work?

Gann fans are constructed by drawing trendlines from a specific anchor point on a price chart, usually a significant high or low. These trendlines are then extended at equal intervals to create a fan-like pattern, which helps traders visualize potential support and resistance levels as well as the direction of market trends.

C. Can Gann indicators predict market crashes?

While Gann indicators can provide insights into market trends and potential reversal points, they cannot predict market crashes with certainty. Market crashes are often influenced by a complex interplay of factors, including economic fundamentals, investor sentiment, and external events. Traders should use Gann indicators as part of a comprehensive trading strategy and exercise caution when making predictions about market crashes.

D. Are Gann indicators suitable for all types of markets?

Gann indicators can be applied to various financial markets, including stocks, forex, commodities, and cryptocurrencies. However, their effectiveness may vary depending on market conditions, volatility, and liquidity. Traders should adapt Gann’s techniques to suit the characteristics of different markets and asset classes.

E. Is Gann analysis subjective?

While Gann analysis involves subjective interpretation of price charts and technical indicators, it is based on objective mathematical and geometric principles. However, individual traders may interpret Gann indicators differently and apply them in various ways based on their trading style, preferences, and experience.

F. Can Gann indicators be automated?

Yes, Gann indicators can be automated using algorithmic trading systems or trading platforms that support automated trading strategies. Traders can develop custom algorithms or use pre-built indicators to incorporate Gann analysis into automated trading systems, allowing for systematic and rule-based trading.

G. Are there any free resources for learning Gann analysis?

Yes, there are several free resources available for learning Gann analysis, including online tutorials, articles, forums, and educational websites. Additionally, many trading platforms offer built-in tools and resources for technical analysis, including Gann indicators and charting tools.

H. Do Gann indicators work better on certain timeframes?

Gann indicators can be applied to various timeframes, including intraday, daily, weekly, and monthly charts. The effectiveness of Gann indicators may vary depending on the timeframe and trading objectives. Some traders may prefer shorter timeframes for intraday trading, while others may focus on longer-term trends for swing trading or investing.

I. Can Gann indicators be used for long-term investing?

Yes, Gann indicators can be used for long-term investing to identify potential trends and reversal points in the market. However, long-term investors should supplement Gann analysis with fundamental analysis and economic research to make informed investment decisions and manage risk effectively.

J. Are there any famous traders who use Gann analysis?

Yes, there are several famous traders and investors who have used Gann analysis in their trading activities, including W.D. Gann himself, as well as other notable figures such as George Bayer, Edson Gould, and Robert Prechter. While Gann analysis may not be as widely used as other forms of technical analysis, it has influenced many traders and investors over the years.