National Holidays Calendar

Forex National Holidays Calendar

Stay informed about upcoming holidays worldwide that impact forex trading schedules and liquidity. Use this tool to plan your trading activities and be aware of market closures.

Key Features:

Comprehensive Coverage: Access a complete list of national holidays observed in major forex markets globally.

Holiday Details: See dates, countries, and how holidays affect forex market hours and liquidity.

Customizable Views: Filter holidays by region or specific dates relevant to your trading.

Upcoming Holidays: Quickly view upcoming holidays in major countries of Europe, the United States, and Asia to prepare for market closures and reduced liquidity.

Trading Insights: Understand how holidays can affect trading volumes and market volatility.

Download and share: Save the calendar or share it with fellow traders and colleagues.

How to Use the Calendar:

Select Region: Choose Europe, United States, or Asia to view relevant holidays in each major country.

View Holiday Details: Check dates and countries observing holidays affecting forex markets.

Plan Your Trading Strategy: Adjust trading schedules around market closures and reduced liquidity.

Stay Informed: Regularly check for updates and additions to the holiday calendar.

Why Use a Forex National Holidays Calendar:

Trading Efficiency: Plan trades based on market hours and liquidity.

Market Awareness: Stay informed about global events impacting forex trading.

Risk Management: Anticipate potential market fluctuations and reduced trading opportunities.

Collaborative Planning: Coordinate trading activities with colleagues and partners.

Example Usage:

Upcoming Holidays:

Europe:

Bastille Day

- Date: July 14th

- Details: Celebrated in France, marking the French Revolution.

Oktoberfest

- Date: September 17th

- Details: Celebrated in Germany for its beer festival.

St. Patrick’s Day

- Date: March 17th

- Details: Celebrated in Ireland, honoring Saint Patrick.

St. Andrew’s Day

- Date: November 30th

- Details: Celebrated in Scotland, honoring the patron saint.

Fiesta Nacional de España

- Date: October 12th

- Details: Celebrated in Spain, commemorating Columbus’s arrival in the Americas.

United States:

Labor Day

- Date: September 5th

- Details: Honors the American labor movement.

Thanksgiving Day

- Date: November 24th

- Details: Day of giving thanks and feasting.

Independence Day

- Date: July 4th

- Details: Commemorates the adoption of the Declaration of Independence.

Memorial Day

- Date: May 30th

- Details: Honors military personnel who died in service.

Christmas Day

- Date: December 25th

- Details: Celebrated as a Christian holiday worldwide.

Asia:

Chinese New Year

- Date: February 1st

- Details: Celebrated in China, marking the lunar new year.

Diwali

- Date: October 24th

- Details: Celebrated in India, known as the Festival of Lights.

Songkran Festival

- Date: April 13th

- Details: Celebrated in Thailand, marking the Thai New Year.

Golden Week

- Date: May 1st – May 5th

- Details: Celebrated in Japan, promoting tourism and leisure.

Eid al-Fitr and Eid al-Adha

- Date: it doesn’t have a static date it’s dynamic

- Details: Celebrated worldwide by Muslims, marking the end of Ramadan fasting.

Use our enhanced Forex National Holidays Calendar to optimize your trading decisions and navigate global forex markets effectively. Stay ahead of market closures and plan your trades strategically throughout the year.

Which Currency Pairs Are Best for Elliott Wave Traders in 2024?

In 2024, Elliott Wave Theory will remain a pivotal tool for traders navigating the complexities of financial markets. For forex traders, understanding the optimal currency pairs can significantly enhance their

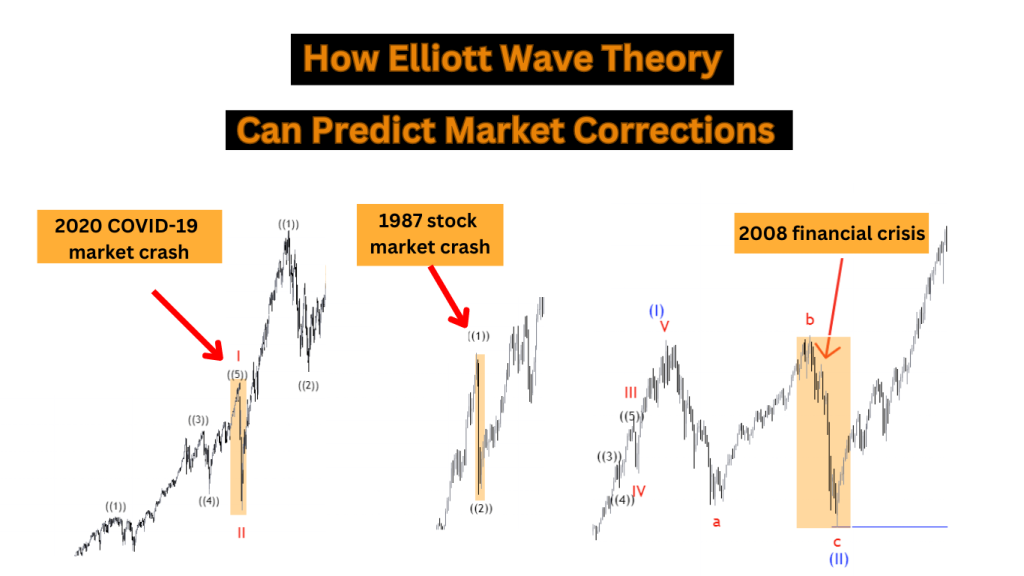

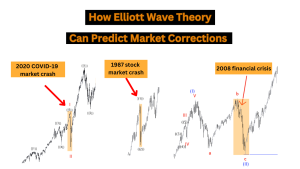

How Elliott Wave Theory Can Predict Market Corrections

Elliott Wave Theory is a powerful tool that traders and investors use to forecast market movements with great accuracy. In the financial markets, predicting market corrections is crucial for maximizing

Machine Learning and Elliott Wave Theory: A New Frontier

In the constantly changing world of financial analysis, Machine Learning (ML) and Elliott wave theory (EWT) are becoming essential tools. Combining these two methods could transform market forecasting, providing exceptional

Top 10 Common Mistakes in Elliott Wave Analysis You MUST Avoid!

Elliott wave analysis is a crucial part of technical analysis. It helps traders and investors understand market trends and potential price changes. Essentially, it says that market prices follow specific

From Novice to Pro: The Ultimate Guide to Cryptocurrency Trading

Cryptocurrency trading has become more than just a trend; It is a global phenomenon that has attracted the attention of both experienced investors and newcomers alike. In this comprehensive guide,

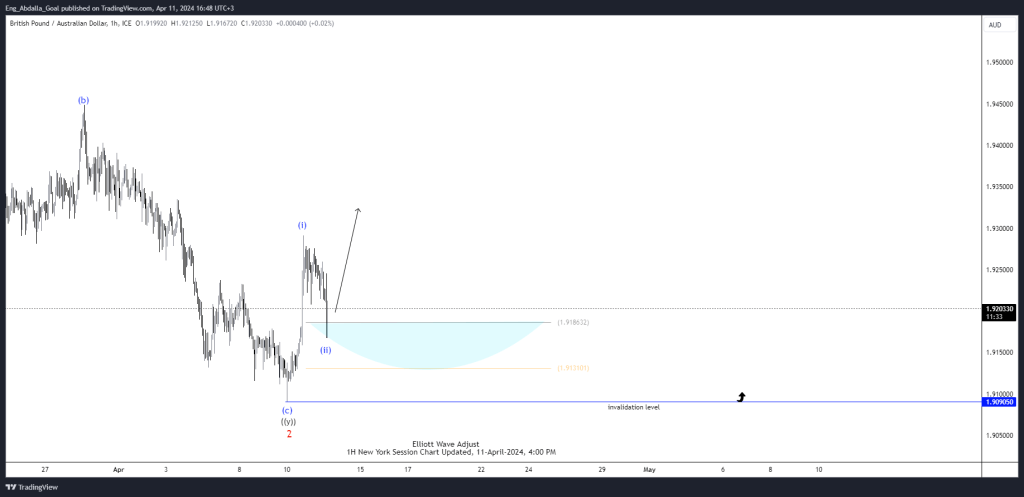

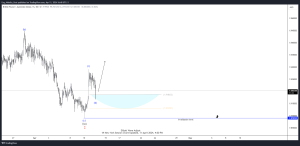

GBPAUD Elliott Wave View: Buyers have taken control after completing the Double-Three Structur

In this technical article we’re going to take a quick look at the Elliott Wave charts of GBPAUD published in members area of the website. Our team recommended members to

This Fibonacci calculator will generate a list of Fibonacci numbers from start and end values