Elliott Wave Theory, in a specialized examination, makes sense of cost changes in financial business sectors. Created by Ralph Nelson Elliott, this device examines rehashing fractal wave designs recognized in stock value developments and customer conduct. Financial backers who benefit from market trends are said to ride the wave.

Elliott Wave Theory: What Is It and How to Utilize It?

Figuring out Elliott Wave Theory:

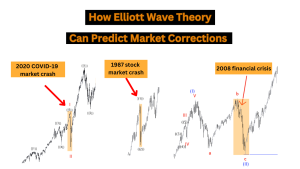

Elliott wave theory was created by Ralph Nelson Elliott during the 1930s. He concentrated on 75 years of hourly and half-hourly yearly, monthly, week-after-week, day-to-day, and home outlines on an assortment of lists. His theory became popular in 1935 when Elliott made a surprising expectation about the lower part of the financial trade and has turned into a staple for a huge number of portfolio directors, merchants, and personal financial backers.

Elliott characterized rules for recognizing, anticipating, and taking advantage of examples in the floods of books, articles, and letters summed up in R.N. Distributed by Elliott’s Showstoppers, 1994. Elliott Wave Global is the biggest free financial examination and market gauging organization offering market investigation and determining considering Elliott models.

Although their examples don’t give conviction about future cost developments, they assist with deciding the likelihood of future market activities. These can be utilized for different types of specialized examinations, like specialized markers.

How does the Elliott Wave work?

A few specialized examiners use Elliott wave theory to benefit from financial trade wave designs. This theory expects that stock value developments can be anticipated because they move in a rehashing design called waves, which are made by financial backers’ brain research and feelings.

This theory is emotional and recognizes two unique kinds of waves: propulsive or shock waves and remedial waves. Wave investigation isn’t identical to a layout for adhering to directions. Wave examination gives knowledge into trend elements and assists financial backers with grasping cost developments.

Drive waves and remedy waves are settled in self-comparable fractals to make bigger examples. For instance, a 1-year diagram can be in a revision wave, while a 30-day graph can show a shock wave. A merchant with this translation of the Elliott Wave can have a bullish viewpoint temporarily but a negative one in the long haul.

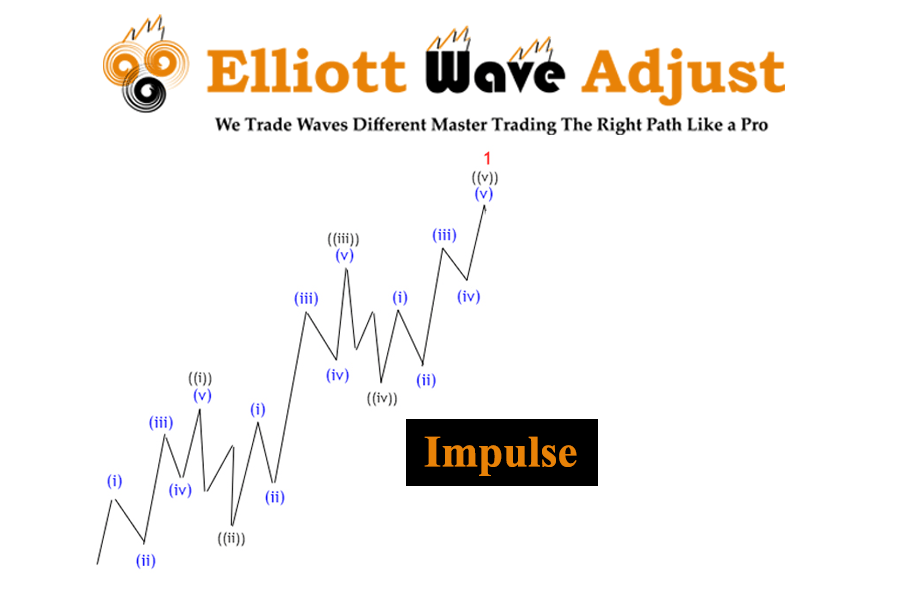

Impulse wave:

A drive wave comprises five sub-waves that have a net development in a similar direction following a higher-order trend. This example is the most widely recognized and simplest to distinguish impetus waves available. It comprises five sub-waves, three of which are propulsive waves. Two are remedial waves.

- Wave 2 can’t be backtracked past the start of Wave 1.

- Wave 3 should not be the most limited wave among the three shock waves, 1, 3, and 5.

- Wave 4 doesn’t cover the Wave 1 cost region.

- The fifth wave should end with a force difference.

If a principle is disregarded, the design is, as of now, not a shock wave. Dealers should relabel dubious drive waves.

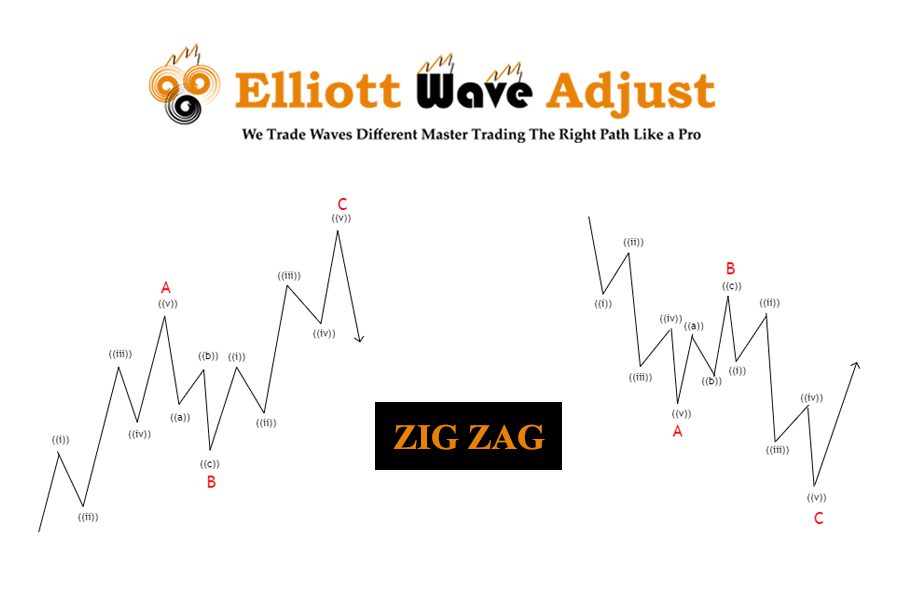

Corrctive wave:

A restorative wave, called a slanted wave, comprises three sub-waves, or a mix of three sub-waves, with a net development the other way to the following higher trend degree. You want to move the market toward the trend.

- The rectification wave comprises five sub-waves.

- Corner-to-corner seems to be a wedge that grows or contracts.

- Contingent upon the kind of corner being noticed, the sub-wave count of the inclining may not be 5.

- Every askew sub wave doesn’t backtrack the past sub wave, and corner-to-corner sub wave 3 may not be the briefest wave.

Elliott wave theory and different markers:

Elliott understood that the Fibonacci grouping addresses a progression of drive waves and rectifications. The connection between cost and time waves likewise typically shows Fibonacci proportions, for example, 38% or 62%. For instance, a rectification wave can have a 38% retracement of the past drive.

Different investigators have created pointers enlivened by Elliott Wave principles, for example, the Elliott Wave oscillator graph. Oscillators give a modernized strategy for foreseeing future cost courses founded on the contrast between 5-period and 34-period moving midpoints. Elliott Wave Worldwide’s AI system, EWAVES, applies all Elliott Wave rules to your information to produce a robotized Elliott Wave examination.

What is Elliott’s wave theory?

In a specialized examination, Elliott wave theory breaks down long-haul trends in value examples and how they relate to financial backing opinions. These valuable examples, or “waves,” rely upon rules created by Ralph Nelson Elliott during the 1930s. These services distinguish and foresee wave designs inside the financial trade and anticipate future developments.

How does the Elliott Wave work?

As per Elliott’s wave theory, market costs change between imprudent and restorative stages. The drive is constantly partitioned into a bunch of five lower-order waves, again rotating persuading and restorative properties, so that waves 1, 3, and 5 are motivations, and waves 2 and 4 are little relapses of waves 1 and 3.

How do I trade utilizing Elliott wave theory?

If a merchant verifies that a stock is ascending in an imprudent wave, the person in question can go on until the fifth wave finishes. Merchants can shorten stocks with at least some expectation of an inversion. The focal point of this trading theory is the possibility that fractal designs rehash in financial business sectors. In math, fractal designs rehash on an endless scale.

What is the Elliott Wave Principle?

The Elliott Wave rule expresses that financial business sectors are dynamic frameworks comprised of over-and-again advancing examples that can be recognized and utilized in successful trading methodologies. As per the guideline, market costs move in waves, mirroring the hidden opinion and course of security.

Elliott wave theory furnishes brokers with data about the potential high and two rectification waves (numbers 2 and 4). Shock waves move toward the general trend, while rectification waves move against it. Investigation of these waveforms gives important data on when to enter and leave positions.

What is the Elliott cycle?

Like business cycles, there are times of development and decline, which are basically because of macroeconomic circumstances, particularly financial and financial strategies. For instance, the Elliott Wave cycle can be the principal buyer market in an economy emerging from a downturn. On the other hand, it very well may be that a subsequent bull pursued the market pullback during a solid general financial recovery.

Conclusion:

Elliott wave theory was created by Ralph Nelson Elliott. Gives a specialized examination of cost designs connected with financial backing opinions and brain science. The theory recognizes shock waves that lay out examples and remedial waves that balance more extensive trends. Stock value developments are considered unsurprising because they rise and fall repeatedly.