We’ll look at three main order types: market orders, limit orders, and stop orders. Understanding these differences is important, as each type can lead to different outcomes. Let’s explore how each one works and when you should use them.

Advanced Order Types: Understanding and Utilizing Limit, Stop, and Market Orders

It’s helpful to think about each type of order as a tool for a specific purpose. When you’re trading, it’s important to know your main goal—whether it’s quickly filling orders at the current market price or controlling trading costs. Then you can decide which type of order best fits your goals.

What is a market order, and how could it be utilized?

A market order is when you trade a stock at the current market price. These orders guarantee execution, but not a specific price. They’re great when you want to quickly make a trade. Market orders work well when you believe the stock price is right, when you need to ensure your order goes through, or when you want fast execution.

Remember: stock quotes usually show the highest price a buyer is willing to pay, the lowest price a seller is willing to accept, and the price at which the last trade was made. However, this last traded price might not be the most recent, especially for less actively traded stocks

The last trade might have happened minutes or hours ago. This also applies to fast-moving markets, where stock prices can change a lot in a short time. So, when you place a market order, the current bid and ask prices are usually more important than the last traded price.

Market orders should be placed when the market is open. If you place a market order when the market is closed, it will be executed when the next market session begins, and its price could be significantly higher or lower than the previous closing price. Several factors can influence stock prices during a trading session, such as earnings releases, company news or financial data, or unexpected events impacting an industry, sector, or the overall market.

Market Orders

Market orders are essential for trading in financial markets, enabling traders to quickly execute transactions at the current market price. Let’s delve into what market orders are, how they work, when to use them, as well as their benefits and risks.

A. Definition and Execution Process

A market order happens when a trader wants to buy or sell a security immediately at the current best price. Unlike limit orders, which choose a specific price, market orders prioritize speed over price precision. When you place a market order, it gets executed at the current price, which may vary due to trading activity and price fluctuations.

B. Use Cases and Advantages

Market orders are often used when speed is really important, like when traders need to buy or sell fast or when trading assets that are easy to trade with small price differences. Here are some good things about market orders:

- Instant Trading: Market orders happen right away, so traders can make trades quickly.

- Always Filled: Usually, market orders get done as long as there’s enough trading happening, so traders know their trades will happen.

- Easy to Use: Market orders are simple, so anyone can use them, no matter how much experience they have.

C. Risks Associated with Market Orders

Even though market orders have good points, they also have some risks:

- Prices Might Change: Market orders happen at the current market price, which might not be the same as what you saw, especially in fast or slow markets.

- Slippage: Sometimes, market orders don’t happen at the price you expected, which can cost more.

- Market Effects: Big market orders can change prices, which can be bad and make trading cost more.

Limit Orders

Limit orders let traders pick the price they want to trade at, giving them more control over their trades. Let’s look into what limit orders are, how they work, the different types, and their pros and cons.

A. Explanation and Functionality

A limit order is when a trader tells the market to buy or sell a security at a certain price or better. Unlike market orders, which focus on being fast, limit orders let traders choose the price they want to trade at. These orders stay active until they get done or the trader cancels them.

B. Types of Limit Orders:

1. Buy Limit Orders

A buy limit order is when traders want to buy at a price lower than what it is now. They use this when they think the price will drop before they want to buy. When the market reaches that price, the order gets triggered, and the trade happens at that price or better.

2. Sell Limit Orders

sell limit order is when traders want to sell at a price higher than what it is now. They use this when they expect the price to go up before they want to sell. When the market reaches that price, the order gets triggered and the trade happens at that price or better.

C. Benefits and Drawbacks of Limit Orders

Benefits:

- Control over Price: Limit orders and let traders pick the exact price they want to trade at.

- Less slippage: Limit orders can lower the chance of unexpected prices compared to market orders.

- Waiting for Good Prices: With limit orders, traders can wait for prices they like before trading.

Drawbacks:

- Order Not Filled: If the market price doesn’t reach the chosen price, the order might not happen.

- Missing Trades: In fast markets, orders might not go through if prices change too quickly.

- Turning into Market Orders: Orders might become market orders if the chosen price is reached, but there’s not enough trading to fill them.

Stop Orders

Stop orders are important for controlling risk and making trades at specific prices. Let’s look into what stop orders are, the different types, how to use them, and how well they work in trading.

A. Understanding Stop Orders

Stop orders, also called stop-loss or stop-entry orders, are used to stop losses or start trades at specific prices. When the price hits the stop price, the order becomes a market order. This lets traders limit losses or take advantage of price changes.

B. Types of Stop Orders:

1. Buy Stop Orders

A buy stop order goes above the current price and gets triggered when the market reaches or goes beyond the chosen stop price. Traders often use these orders to enter long positions when prices break out or go above resistance levels.

2. Sell Stop Orders

A sell stop order goes below the current price and gets triggered when the market reaches or falls below the chosen stop price. Traders use these orders to stop losses or start short positions when prices break down or go below support levels.

C. Application and Effectiveness in Trading Strategies

Stop orders are important for managing risk and making trades. Some common uses include:

- Managing Risk: Traders use stop orders to set points where they’ll exit to avoid big losses or protect profits.

- Following Trends: Stop orders help traders get into trades that follow the trend, so they can make gains while keeping risks in check.

- Dealing with Volatility: In volatile markets, stop orders let traders join in when prices break out or down, so they can take part in big moves while staying safe.

What is a limit order, and how can it function?

A limit order is an order to trade a stock with a limit at the most exorbitant cost paid (with a purchase limit) or the least cost got (with a sell limit). If your order is executed, it may be executed at or over the maximum possible cost. In any case, there is no assurance that it will be executed. A limited order can be suitable if you accept you can purchase at a lower cost or sell at a greater cost than the ongoing business sector cost.

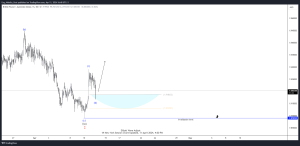

The diagram above shows the utilization of market and limit orders. In this model, the last trade cost was around $139.

- Merchants who need to trade stock as fast as conceivable submit a market order. The stock will, in a split second, top off at or close to the ongoing cost of $139 (white line). It opens when an order is put in place, except if uncommon economic situations exist.

- A merchant who needs to purchase the stock if it drops to $133 would put in a purchase limit order with a limit cost of $133 (green line). If the stock cost falls below that level, the limit order will be set off, and the order will be executed below $133. If the stock price doesn’t fall below $133, no execution will happen.

If the stock cost transcends that level, the limit order will be set off, and the order will be executed above $142. If the stock cost doesn’t surpass $142, no execution will happen. If it’s not too much trouble, note that regardless of whether stock arrives at the highest possible value, your order may not be filled due to pre-orders.

All things considered, your order may not be filled because there may not be sufficient (or extra) vendors ready to sell at that limited cost. (Limit orders are for the most part executed on a first-come, first-served premise.) However, your order can be filled at a higher cost. For instance, a purchase order can be executed underneath the limit cost, and a sell order can be executed over the limit cost.

What is a stop order and how could it be utilized?

A stop order is an order to trade a stock at the market cost after the stock has traded at a particular value (the “stop cost”). When the stock arrives at the stop value, your order turns into a market order and will be executed at the following accessible market cost. If the stock cost doesn’t arrive at the stop value, the order won’t be executed.

Stop orders can be appropriate for situations, for example,

- If the stocks you currently own have gone up, you need to safeguard a portion of your hidden increases if they begin to go down.

- If you have as of late bought a stock and need to set a lower limit around the degree of misfortune you can endure in that position,.

- When you need to purchase a stock, if its cost transcends a specific level, you can flag the start of a subsequent rise.

Sell-stop orders are in some cases called “stop-misfortune” orders since they can be utilized to safeguard undiscovered gains or limit misfortunes. A sell order is placed with a stop cost lower than the ongoing business sector cost.

If the stock tumbles to the stop cost (or trades underneath the stop value), a stop-sell order is set off and turns into a market order executed at the ongoing business sector cost. This sell-stop order isn’t destined to be executed close to the stop cost.

Stop orders can likewise be utilized for buys. A purchase stop order is placed with a stop value that is higher than the ongoing business sector cost (basically “forestalling” the stock cost from moving ceaselessly as it rises).

We should take a gander at the past model once more. We should investigate the possible effect of utilizing a stop order to purchase and a stop order to sell, with a similar stop cost as the limit cost utilized previously.

Note that although the two charts seem comparative, the places of the red and green bolts are switched. A sell-stop order will be set off when the stock cost comes to $133 (or less) and will be executed as a market order at the ongoing time. cost. Subsequently, if the stock cost falls further in the wake of arriving at the limit value, your order can be executed at a cost lower than the limit cost. On the other hand, for a purchase stop order, if the stock cost comes to $142, the purchase stop order can be executed at a greater cost.

Frequently Asked Questions (FAQs)

Navigating the complexities of trading orders can be daunting for both novice and experienced traders alike. Here are some frequently asked questions (FAQs) to help you understand the differences between market, limit, and stop orders, as well as considerations for their use and potential risks involved.

A. How do I choose between market, limit, and stop orders?

Choosing between market, limit, and stop orders depends on your trading objectives, market conditions, and risk tolerance:

- Market Orders: Use market orders when speed of execution is crucial, and you’re willing to accept the prevailing market price.

- Limit Orders: Opt for limit orders when you want to specify the exact price at which you’re willing to buy or sell a security, and you’re willing to wait for the market to reach that price.

- Stop Orders: Employ stop orders to manage risk by setting predetermined entry or exit points based on price movements, such as stop-loss orders to limit losses or stop-entry orders to enter trades at breakout levels.

B. Can I cancel or modify advanced orders once placed?

Yes, many trading platforms allow you to cancel or modify advanced orders, such as limit and stop orders, after they have been placed. However, it’s essential to familiarize yourself with your broker’s order execution policies and understand any limitations or restrictions that may apply to order modifications or cancellations.

C. What are the risks of using advanced order types?

While advanced order types offer greater flexibility and control over trade execution, they also carry certain risks:

- Execution Risk: Advanced orders may not be executed as expected due to market volatility, liquidity constraints, or price gaps.

- Slippage: Slippage can occur when the execution price of an order differs from the expected price, resulting in higher transaction costs.

- Order Rejections: In fast-moving markets or during periods of high volatility, brokers may reject or delay the execution of advanced orders, leading to missed trading opportunities.

D. How do I prevent order slippage?

To minimize the risk of order slippage, consider the following strategies:

- Set Realistic Price Targets: Avoid setting overly aggressive price targets that may be difficult to fill in fast-moving markets.

- Monitor Market Conditions: Stay informed about market trends, liquidity levels, and upcoming events that could impact order execution.

- Use Limit Orders: Use limit orders instead of market orders whenever possible to specify the price at which you’re willing to execute a trade.

E. Are there any regulatory considerations for advanced order types?

Regulatory requirements governing advanced order types may vary by jurisdiction and exchange. It’s essential to familiarize yourself with the regulatory framework applicable to your trading activities, including any rules or guidelines related to order types, execution policies, and investor protection measures. Additionally, be sure to review your broker’s terms of service and disclosure documents to understand their obligations and responsibilities regarding order execution and client protection.

In conclusion, understanding the differences between market, limit, and stop orders, as well as their respective advantages, risks, and regulatory considerations, is essential for making informed trading decisions and managing risk effectively in the financial markets.