Related Blog Posts

Machine Learning and Elliott Wave Theory: A New Frontier

In the constantly changing world of financial analysis, Machine Learning (ML) and Elliott wave theory (EWT) are becoming essential tools. Combining these two methods could transform market forecasting, providing exceptional

From Novice to Pro: The Ultimate Guide to Cryptocurrency Trading

Cryptocurrency trading has become more than just a trend; It is a global phenomenon that has attracted the attention of both experienced investors and newcomers alike. In this comprehensive guide,

Elliott wave View: Bitcoin (BTCUSD) Entering Into A Wave Five Lower

The short-term Elliott wave view in BTCUSD suggests that the decline from March 28, 2022, High is unfolding as an impulse structure favoring some more downside. Down from 03/28/2022 high,

Elliott Wave View: AUDUSD any Rally it can Fail for More Downside

The short-term Elliott Wave view on AUDUSD suggests that the cycle from the 8.11.2022 high is in progress as a 5 waves impulse structure. Down from the 8.11.2022 high, wave

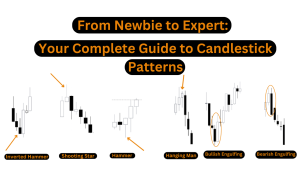

From Newbie to Expert: Your Complete Guide to Candlestick Patterns

Candlestick patterns are important in trading analysis. They show market sentiment and potential price changes. Knowing these patterns helps traders understand market behavior better than just looking at prices. What

High-Frequency Trading Techniques and Measurements

High-Frequency Trading: A high-frequency trading system is a trading technique that utilizes strong PC projects to execute many trades in a negligible part of a second. This is a sort