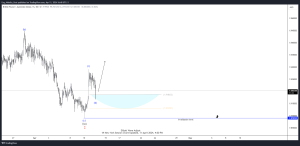

The short-term Elliott wave view in BTCUSD suggests that the decline from March 28, 2022, High is unfolding as an impulse structure favoring some more downside. Down from 03/28/2022 high, wave (1) ended in 5 waves at $38550 low. Wave (2) ended at $42974 high, and wave (3) ended in 5 waves at $25384 low. Then above there, the pair made a bounce in wave (4) in a shorter cycle. The internals of that bounce unfolded as a double three structure.

Whereas the initial 3 waves bounce to $31420 ended wave W. Then a pullback to $27953 low-ended wave X. Up from there, the pair started the Y leg higher & reached $323770. The pair got rejected within that area & ended Y leg at $32370 high thus completing the wave (4) bounce. Below from there, we believe wave (5) has started lower where Miner degree wave 1 ended at $29258 low. And wave 2 ended at $31540 high. Near-term, as far as bounces fail below $31540 high and more importantly below $32370 high the pair is expected to see more downside towards $23780- $21114 inverse 123.6%- 161.8% Fib ext area of (4) minimum. Before the pair completes its 5 waves impulse sequence from March/28/2022 high & does a bounce.

BTCUSD 1 Hour Elliott Wave Chart 23 May 2022

BTCUSD 1 Hour Elliott Wave Chart 01 Jun 2022

BTCUSD 1 Hour Elliott Wave Chart 09 Jun 2022

BTCUSD 1 Hour Elliott Wave Chart 14 Jun 2022

Whatch Full Video

Most Recent Posts

Which Currency Pairs Are Best for Elliott Wave Traders in 2024?

In 2024, Elliott Wave Theory will remain a pivotal tool for traders navigating the complexities of financial markets. For forex traders, understanding the optimal currency pairs can significantly enhance their

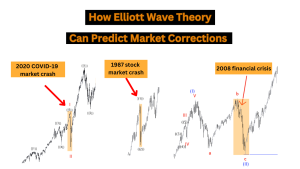

How Elliott Wave Theory Can Predict Market Corrections

Elliott Wave Theory is a powerful tool that traders and investors use to forecast market movements with great accuracy. In the financial markets, predicting market corrections is crucial for maximizing

Machine Learning and Elliott Wave Theory: A New Frontier

In the constantly changing world of financial analysis, Machine Learning (ML) and Elliott wave theory (EWT) are becoming essential tools. Combining these two methods could transform market forecasting, providing exceptional

Top 10 Common Mistakes in Elliott Wave Analysis You MUST Avoid!

Elliott wave analysis is a crucial part of technical analysis. It helps traders and investors understand market trends and potential price changes. Essentially, it says that market prices follow specific

From Novice to Pro: The Ultimate Guide to Cryptocurrency Trading

Cryptocurrency trading has become more than just a trend; It is a global phenomenon that has attracted the attention of both experienced investors and newcomers alike. In this comprehensive guide,

GBPAUD Elliott Wave View: Buyers have taken control after completing the Double-Three Structur

In this technical article we’re going to take a quick look at the Elliott Wave charts of GBPAUD published in members area of the website. Our team recommended members to