Elliott Wave Theory has been a cornerstone in the world of technical analysis, providing traders and investors with a unique perspective on market trends and movements. In this comprehensive guide, we will delve into the intricacies of mastering Elliott Wave Theory, offering beginners a solid foundation to navigate the complex waves of financial markets.

In the words of renowned financial analyst John Templeton, “The four most dangerous words in investing are: ‘This time it’s different.’ But with Elliott Wave Theory, it’s about recognizing patterns that transcend time, providing a unique perspective on market dynamics.”

I. Introduction to Elliott Wave Theory

A. Overview of Elliott Wave Principle

The Elliott Wave Principle, conceived by Ralph Nelson Elliott in the 1930s, is a form of technical analysis that suggests financial markets move in recognizable patterns or waves. These patterns are attributed to investor psychology, which alternates between periods of optimism (bull markets) and pessimism (bear markets).

Example:

In an uptrend, the Elliott Wave Principle identifies a sequence of five waves, with three progressing in the direction of the trend (impulse waves) and two moving against it (corrective waves).

B. Historical Background

Understanding the historical background provides context to the development of Elliott Wave Theory. Ralph Nelson Elliott formulated his ideas after extensive study of market charts, recognizing repetitive patterns in price movements.

Example:

Elliott’s observations of market trends during the Great Depression led to the identification of distinct wave patterns, laying the foundation for his groundbreaking theory.

C. Purpose and Application

The primary purpose of Elliott Wave Theory is to forecast future price movements by analyzing and identifying repetitive wave patterns. Traders and investors use this theory to make informed decisions about market trends, entry points, and potential reversals.

Example:

By applying Elliott Wave Theory, analysts aim to anticipate the completion of corrective waves and the resumption of the prevailing trend, aiding in strategic decision-making.

II. The Fundamentals of Elliott Wave Theory

A. Understanding Market Movements

To grasp the fundamentals of Elliott Wave Theory, it’s essential to understand the basic concept that market movements are not random. Instead, they follow a rhythmical pattern of waves driven by collective investor psychology.

Example:

Recognizing that market movements are not chaotic but exhibit identifiable patterns helps traders apply Elliott Wave Theory with more confidence.

B. The Five-Wave Structure

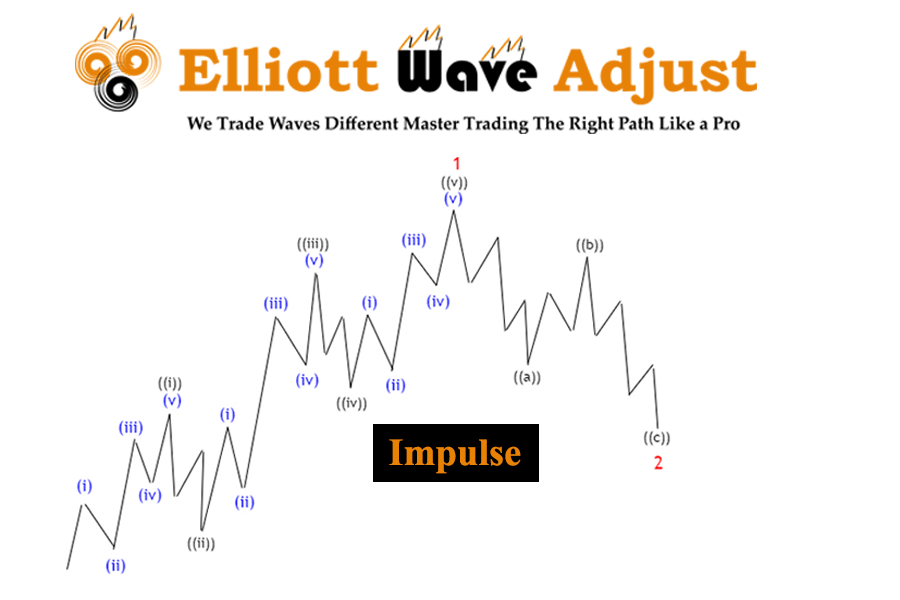

- Impulse Waves

Impulse waves represent the primary direction of the market trend, consisting of five sub-waves labeled 1, 2, 3, 4, and 5. These waves are characterized by strong price movement in the direction of the prevailing trend.

- Corrective Waves

Corrective waves, labeled A, B, and C, are counter-trend movements that follow impulse waves. They represent a temporary interruption in the prevailing trend before resuming in the same direction.

Example:

In an uptrend, an impulse wave would consist of five ascending waves, while a corrective wave would involve a downward movement in three waves before the uptrend resumes.

C. The Three Wave Rules

- Wave 2 Never Retraces More than 100% of Wave 1

This cardinal rule emphasizes that the second wave in an impulse sequence should not completely erase the progress made by the first wave. It helps traders identify potential entry points.

- Wave 3 Is Never the Shortest

Wave 3, often the most dynamic and extended wave, should not be the shortest among the impulse waves. This rule helps in confirming the strength of the prevailing trend.

- Wave 4 Does Not Overlap with Wave 1

The fourth wave should not overlap with the territory of the first wave. This rule helps traders confirm the structure of the impulse wave sequence.

Example:

Observing these cardinal rules assists analysts in validating the correctness of identified Elliott Wave patterns and making more informed predictions about future market movements.

III. Identifying Elliott Waves

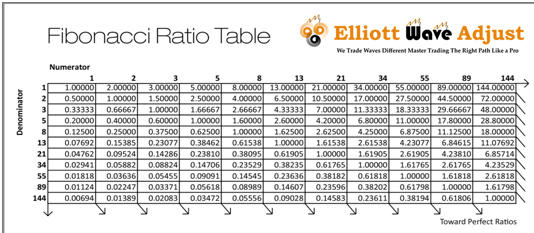

A. Fibonacci Retracement Levels

One of the tools used in identifying Elliott Waves is Fibonacci retracement levels. Traders apply these levels to gauge potential reversal points in a price chart, helping confirm the accuracy of wave counts.

Example:

If a corrective wave retraces approximately 61.8% of the preceding impulse wave, it suggests a potential turning point based on Fibonacci retracement levels.

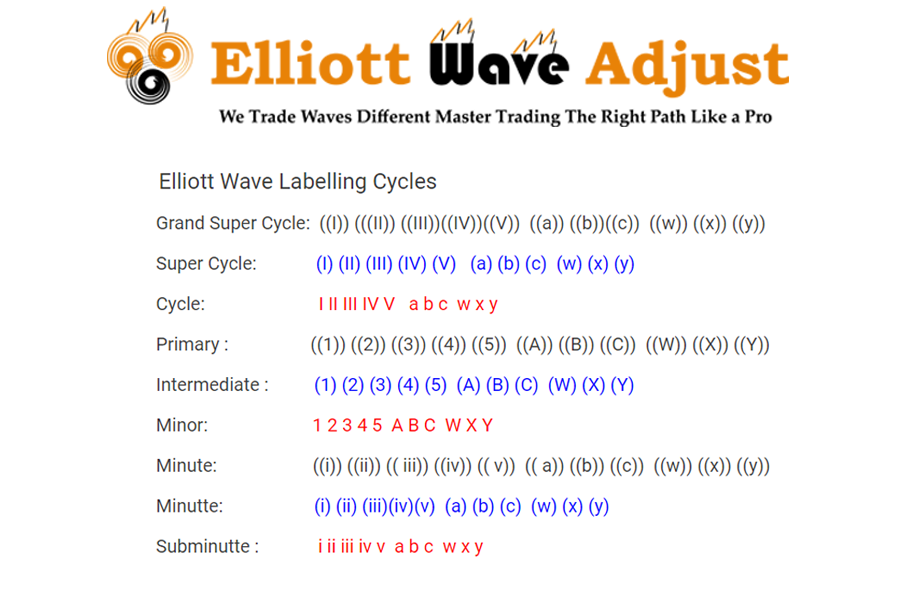

B. Wave Degrees

Understanding wave degrees involves categorizing waves based on their significance and duration. This hierarchical structure provides a framework for analyzing trends across different timeframes.

Example:

Identifying a major trend shift may involve analyzing waves at a higher degree, such as the transition from a bear market (primary wave) to a bull market (cycle wave).

1. Grand Supercycle

This represents the longest-term degree, capturing multiple market cycles over decades. Traders use this degree for a broad perspective on market trends.

2. Supercycle

A supcycle encapsulates several years and is a longer-term trend within the grand supercycle. It provides insights into the overall market direction.

3. Cycle

The cycle degree analyzes medium-term trends, typically spanning one to several years. It helps traders identify major bullish or bearish movements.

4. Primary

Primary waves capture trends over several months and are crucial for understanding the intermediate-term market direction.

5. Intermediate

Intermediate waves help identify trends over weeks to months and provide a more detailed view of market movements within the larger primary trend.

6. Minor

Minor waves are shorter-term movements that contribute to the intermediate degree, offering insights into shorter market trends.

7. Minute

Minute waves are even shorter in duration, providing details on intraday movements and contributing to minor waves.

8. Minuet

Minuette waves represent very short-term movements, offering a granular view of market fluctuations.

9. Sub-Minuette

Sub-Minuette waves are the smallest degree in the Elliott Wave hierarchy, focusing on extremely short-term price actions.

Example:

Analyzing wave degrees’ aids traders in aligning their strategies with different timeframes, catering to both short-term and long-term market perspectives.

IV. Practical Application of Elliott Wave Theory

A. Reading and Analyzing Price Charts

Practical application of Elliott Wave Theory begins with the ability to read and analyze price charts effectively. Traders use the theory to identify and label wave patterns on charts, discerning between impulse waves and corrective waves. This process involves recognizing the sequence of waves and understanding their implications for future price movements.

Example:

By identifying a completed five-wave impulse sequence, a trader might anticipate a three-wave correction to follow. Analyzing price charts helps in making informed decisions about entry and exit points.

B. Case Studies

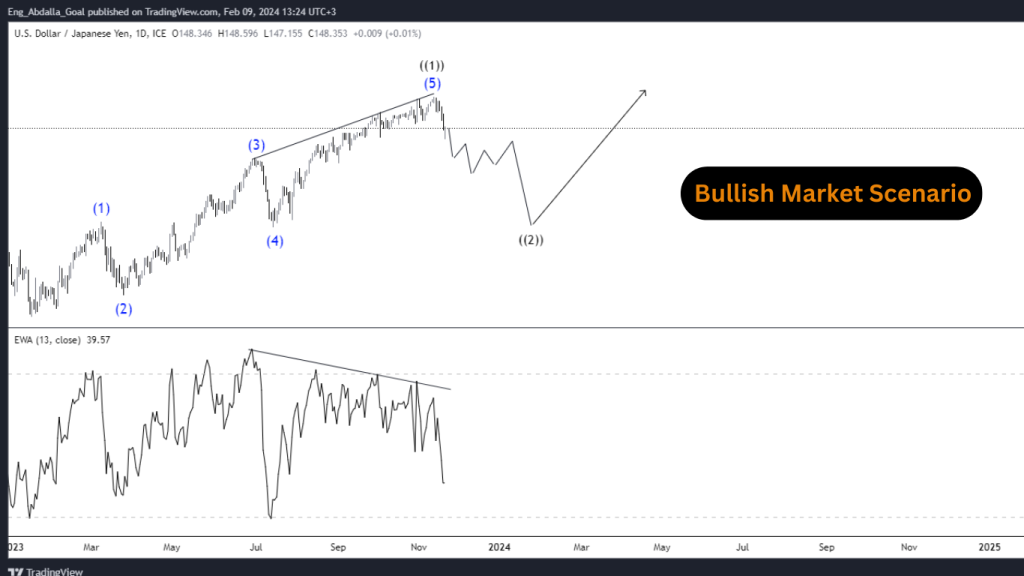

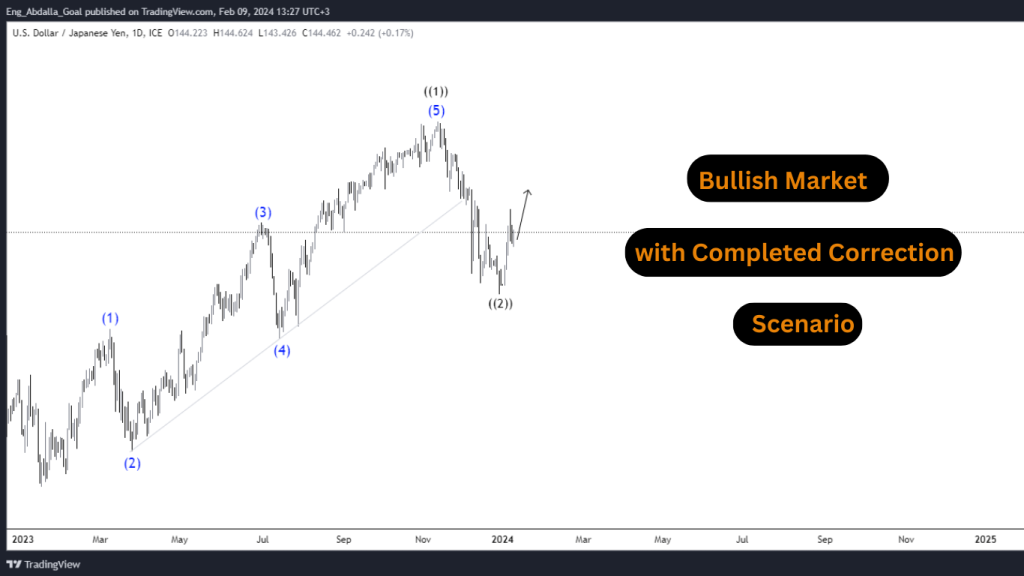

1. Bullish Market Scenario

In this section, traders explore case studies illustrating how Elliott Wave Theory can be applied to identify and capitalize on a bullish market scenario. This involves breaking down a real-world example where an upward trend is correctly identified using the theory. Key components include recognizing the five-wave structure and understanding the potential for further upward movement.

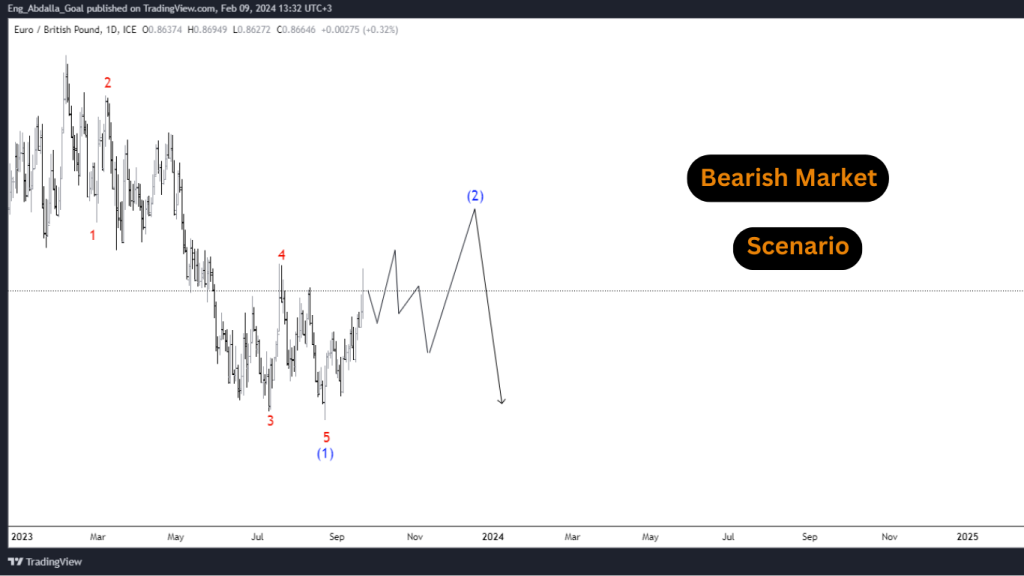

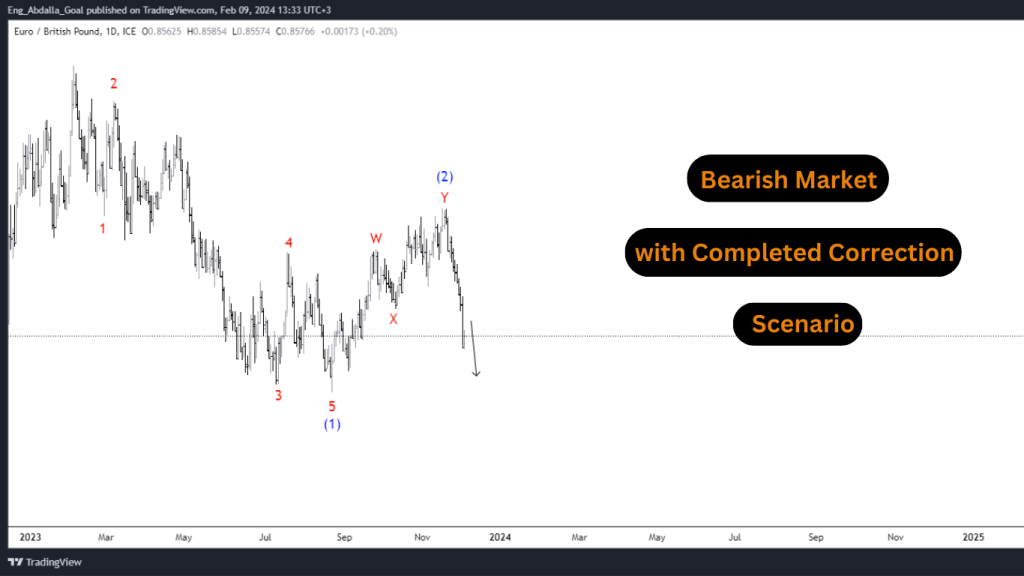

2. Bearish Market Scenario

Similarly, a bearish market scenario case study demonstrates the effectiveness of Elliott Wave Theory in predicting and navigating downtrends. Traders learn to identify the completion of an impulse wave and the subsequent corrective waves indicating a potential downtrend.

V. Common Pitfalls for Beginners

A. Misinterpretation of Waves

One common pitfall for beginners is the misinterpretation of waves. Novice traders may struggle to differentiate between impulse and corrective waves or miscount wave patterns. This misinterpretation can lead to inaccurate predictions and trading decisions.

Mitigation:

Educational resources, hands-on practice, and exposure to real market scenarios can help beginners refine their ability to interpret waves accurately. Seeking mentorship or guidance from experienced traders is also beneficial.

B. Overemphasis on Predictions

Another pitfall involves beginners placing too much emphasis on making precise predictions based solely on Elliott Wave analysis. While the theory provides a valuable framework, markets are influenced by numerous factors, and overreliance on predictions can result in missed opportunities and increased risk.

Mitigation:

Encouraging beginners to view Elliott Wave Theory as one tool among many in their toolkit helps strike a balance. Emphasizing risk management and the probabilistic nature of trading fosters a more realistic approach.

- Ignoring Other Technical Analysis Tools

Some beginners may fall into the trap of relying exclusively on Elliott Wave analysis and ignoring complementary technical analysis tools. This tunnel vision can limit their ability to make well-rounded trading decisions.

Mitigation:

Educating beginners about the importance of integrating Elliott Wave analysis with other indicators, such as moving averages or trend lines, enhances their overall analytical capabilities. A holistic approach to technical analysis is often more effective.

VI. Advanced Concepts in Elliott Wave Theory

A. Alternation Principle

The alternation principle is an advanced concept within Elliott Wave Theory that recognizes the non-uniform nature of corrective waves. Instead of assuming identical structures in corrective waves, the alternation principle suggests that variations in complexity and duration are common.

Example:

A corrective wave following a simple, sharp decline (zigzag) might be followed by a more complex, time-consuming correction (flat or triangle). Traders use this concept to anticipate the nature of upcoming corrections.

B.Channeling Techniques

Advanced practitioners employ channeling techniques to refine their Elliott Wave analysis. Channels are trend lines drawn above and below price movements, helping to visualize the potential path of future waves.

Example:

Drawing channels around impulse waves aids in identifying potential turning points for corrective waves. Traders use channeling to set targets and confirm the validity of their wave counts.

C. Multiple Time Frame Analysis

Engaging in multiple time frame analysis is an advanced strategy that involves examining Elliott Wave patterns across different time frames simultaneously. This approach provides a more comprehensive understanding of the overall market trend.

Example:

While a daily chart may indicate an ongoing corrective wave, a weekly chart may reveal a larger-degree impulse wave. Multiple time frame analysis helps traders align their strategies with broader market trends.

VII. Developing Your Elliott Wave Trading Strategy

A. Combining with Other Indicators

Successful traders often integrate Elliott Wave analysis with other technical indicators to strengthen their trading strategies. This involves using tools like moving averages, Relative Strength Index (RSI), or Moving Average Convergence Divergence (MACD) alongside wave analysis.

Example:

Confirmation of an Elliott Wave pattern on a price chart, combined with a bullish divergence on the RSI, may enhance the confidence in a potential upward movement.

B. Setting Realistic Targets

Developing an effective Elliott Wave trading strategy includes setting realistic targets for entry, exit, and stop-loss levels. Traders need to establish clear objectives based on the identified wave patterns and market conditions.

Example:

If a trader identifies the completion of an impulse wave, setting a realistic target for the ensuing corrective wave ensures a disciplined approach to profit-taking.

C. Risk Management Strategies

Implementing sound risk management strategies is fundamental to any successful trading plan, including those centered around Elliott Wave analysis. Traders must determine acceptable levels of risk for each trade and incorporate this into their overall strategy.

Example:

Using a fixed percentage of the trading capital for each position, setting stop-loss orders based on wave invalidation levels, and diversifying across multiple assets are examples of effective risk management strategies.

VIII. Overcoming difficulties in Elliott wave analysis

A. Dealing with Ambiguous Waves

Navigating through ambiguous wave patterns is a common hurdle. Traders often face situations where it’s challenging to clearly identify and label waves. Here are strategies to tackle such scenarios:

- Pattern Recognition Techniques

Recognize patterns within ambiguous waves by employing advanced pattern recognition techniques. This involves comparing current wave patterns with historical data to identify similarities.

- Focus on Higher Timeframes

Switching to higher timeframes can provide a broader perspective, making it easier to identify the overall trend and subsequently decipher ambiguous waves with greater clarity.

B. Adjusting Strategies in Dynamic Markets

Markets are dynamic entities, and what worked yesterday might t not be as effective today. Adapting your strategies to evolving market conditions is essential. Here’s how to approach it:

- Regularly Update Your Analysis

Conduct regular updates on your analysis to account for changes in market sentiment, economic indicators, and geopolitical factors. This ensures your strategies remain relevant.

- Stay Informed About External Factors

Keep a close eye on external factors that can impact the markets, such as economic reports, political developments, and global events. This information is crucial for making informed adjustments to your strategies.

C. Continuous Learning and Adaptation

In the fast-paced world of finance, continuous learning is not a luxury but a necessity. The ability to adapt to new information and changing market conditions separates successful traders from the rest. Consider the following:

- Stay Updated on Market Trends

Regularly update your knowledge on market trends, new analysis tools, and emerging technologies. Attend webinars, read relevant literature, and participate in forums to stay informed.

- Learn from Mistakes

Embrace mistakes as learning opportunities. Analyze unsuccessful trades or predictions, understand the reasons behind them, and use that knowledge to refine your approach in future endeavors.

IX. Resources for Further Learning

A. Books and Publications

Expanding your knowledge beyond the basics is crucial. Explore these recommended books and publications to deepen your understanding of Elliott Wave Theory:

- “Elliott Wave Principle” by Robert Prechter and A.J. Frost

- “Mastering Elliott Wave” by Glenn Neely

B.Online Courses and Webinars

Hands-on experience and practical insights can significantly enhance your understanding. Consider enrolling in online courses and webinars that offer real-world applications:

- Investopedia’s “Elliott Wave Theory” Course

- Webinars by Elliott Wave International

- Advanced Elliott Wave Course by Elliott Wave Adjust

C. Joining Community Forums

Connecting with fellow traders provides a platform for shared experiences and diverse perspectives. Engage in community forums dedicated to Elliott Wave Theory:

- Forex Factory’s Elliott Wave Discussions

- The Wave Analyst Forum

X. Real-world Success Stories

A. Traders Who Mastered Elliott Wave Theory

Inspiration can often be drawn from the success stories of those who have mastered Elliott Wave Theory. Explore narratives of successful traders who attribute their achievements to this methodology:

Elliott Wave Theory is a technical analysis approach that attempts to forecast financial market trends and cycles by identifying recurring wave patterns. While it’s challenging to attribute mastery of the theory to specific individuals, there are traders and analysts who are well-known for their expertise in applying Elliott Wave principles. Here are a few notable names:

- Robert Prechter: He is considered one of the foremost experts on Elliott Wave Theory. Prechter co-authored a seminal book on the subject titled “Elliott Wave Principle” with A.J. Frost. He is the founder of Elliott Wave International, a prominent financial forecasting firm.

- Glenn Neely: Neely is a respected market analyst who developed a modified version of the Elliott Wave Theory known as NeoWave. His book, “Mastering Elliott Wave,” outlines his approach to wave analysis.

- Steven Poser: A market analyst and commentator, Poser has gained recognition for his application of Elliott Wave Theory in his market analyses. He has contributed to the field through his writings and presentations.

- Hamilton Bolton: While not exclusively an Elliott Wave analyst, Bolton is often credited with discovering and popularizing the Elliott Wave Theory. His work laid the foundation for later developments in wave analysis.

- Tony Caldaro: Caldaro is known for his extensive research and application of Elliott Wave Theory. He shares his analyses and insights on various financial markets through his website and forums.

- Abdalla Goal: A market analyst and commentator, Abdalla is known for his extensive

Counting charts and forecasting market direction has gained recognition for his New Elliott Wave Theory, He shares his analyses and insights on various financial markets through his website.

Remember that trading and market analysis involve risks, and there are diverse opinions on the effectiveness of Elliott Wave Theory. Traders often use a combination of technical and fundamental analysis along with risk management strategies for successful trading.

B. Notable Predictions and Market Analyzes

Highlighting instances where Elliott Wave Theory accurately predicted market movements reinforces its practical efficacy:

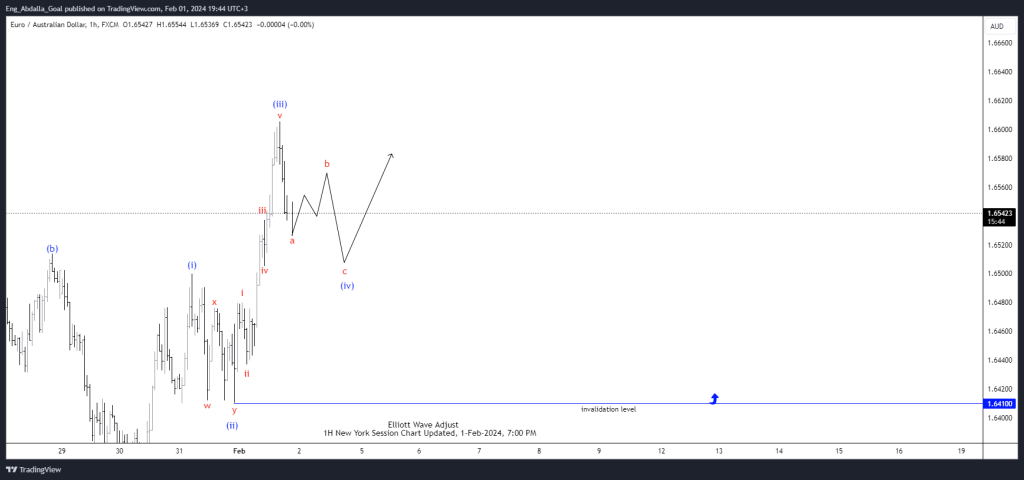

EURAUD 1H Chart 29 Jan 2024

XI. Criticism and controversy

A. The debate in the economy

Address skepticism within the financial community regarding the reliability of Elliott Wave Theory.

Provide balanced perspectives on common criticisms and misconceptions surrounding Elliott Wave Theory, offering clarity.

Acknowledge the skepticism surrounding Elliott Wave Theory within the financial community. While some traders swear by it, others remain doubtful. Delve into the reasons behind this skepticism:

- Subjectivity Concerns

Critics argue that the subjective nature of wave interpretation can lead to different analysts arriving at varying conclusions.

- Market Efficiency Debate

Some academics question whether markets are truly predictable in the way Elliott Wave Theory suggests, raising concerns about its practical application.

B. Addressing Common Criticisms

Maintain objectivity by addressing common criticisms and misconceptions. Offering balanced perspectives ensures a fair evaluation of Elliott Wave Theory:

- Relying Solely on Elliott Wave Analysis

Acknowledge that successful trading often requires a combination of technical and fundamental analysis, and that relying solely on Elliott Wave Theory may be limiting.

- Practical Challenges for Beginners

Recognize the challenges beginners face in mastering the intricacies of Elliott Wave Theory and emphasize the importance of patience and practice.

C.Evolution and Adaptation of the Theory

Highlight how Elliott Wave Theory has evolved over time, incorporating new tools and technologies. Discuss how the theory adapts to stay relevant in an ever-changing financial landscape.

XII. The Future of Elliott Wave Theory

A. Integration with Artificial Intelligence

Explore the potential synergy between Elliott Wave Theory and artificial intelligence. Discuss how AI technologies can enhance the accuracy and efficiency of wave analysis:

- Pattern Recognition Algorithms

Examine how AI-driven pattern recognition algorithms can automate the identification of Elliott Waves, reducing subjectivity.

- Big Data Analysis

Discuss the role of big data in analyzing vast amounts of market information, providing a more comprehensive foundation for Elliott Wave analysis.

B. Potential Developments in Analysis Tools

Anticipate potential developments in analysis tools designed to facilitate the application of Elliott Wave Theory:

- User-Friendly Software

Explore the possibility of user-friendly software that simplifies the process of Elliott Wave analysis, making it accessible to a broader audience.

- Integration with Trading Platforms

Discuss how the integration of Elliott Wave analysis tools with popular trading platforms can streamline decision-making for traders.

C. Continuing Relevance in Modern Markets

Despite technological advancements, emphasize the enduring relevance of Elliott Wave Theory in modern financial markets:

- Psychology and Market Sentiment

Highlight how the theory’s focus on investor psychology and market sentiment remains timeless, providing insights into market dynamics.

- Adaptation to Cryptocurrency Markets

Discuss how Elliott Wave Theory adapts to emerging markets, such as cryptocurrencies, and its potential applications in these evolving landscapes.

XIII. Conclusion

A. Recapitulation of Key Concepts

Summarize the key concepts covered throughout this guide, reinforcing the foundational elements of Elliott Wave Theory:

- Five-Wave Structure

- Wave Degrees and Hierarchy

- Application and Case Studies

- Challenges and Adaptation

B. Encouragement for Beginners

Offer words of encouragement to beginners, emphasizing that mastering Elliott Wave Theory is a gradual process that requires dedication, practice, and a willingness to learn from both successes and failures.

C. Embracing the Dynamic Nature of Financial Markets

Conclude by acknowledging the dynamic nature of financial markets and encouraging readers to embrace this dynamism, continuously learning, adapting, and evolving with the ever-changing landscape.

Conclusion

As we conclude this beginner’s guide to mastering Elliott Wave Theory, one cannot ignore the intriguing blend of art and science that defines successful implementation. The questions posed at the beginning find answers in the strategic application of this theory, offering a roadmap for traders navigating the complexities of the financial markets.

In the world of trading, where uncertainty looms large, Elliott Wave Theory stands as a powerful tool. Embrace the patterns, decipher the waves, and master the art of predicting market movements with this comprehensive guide. Remember, the journey to mastery is a series of waves – ride them wisely, and success will follow.