Forex is the largest market worldwide and where many new traders start. You don’t need a lot of money to make a profit, but having more funds can make it easier to use advanced strategies or trade on a larger scale. Fortunately, there is a way to trade big and punch above your weight even if you start forex trading with limited capital.

Considering that the majority of successful forex traders achieve a monthly gain of 3-5%, it can be challenging to reach a point where you can trade full time. Despite the low entry barrier for starting in forex trading, having a substantial amount of capital is essential to approach this industry seriously, especially if you’re aiming for average returns in the market.. This is where prop firms come into the mix, offering funded accounts to forex traders getting consistent returns, to choose which prop firm is fits you we made review for Top 4 Funded Trader Programs in 2022.

True Forex Fund is a new prop firm offering capital to profitable forex traders around the world. The firm is completely online, meaning traders from anywhere in the world have the option to get funded and progress their trading career.

The company operates entirely online, providing traders worldwide with the opportunity to receive funding and advance their trading careers. Despite funding traders globally, the company is headquartered in Hungary. The emergence of numerous proprietary trading firms from Eastern European regions is a trend worth monitoring in the future.

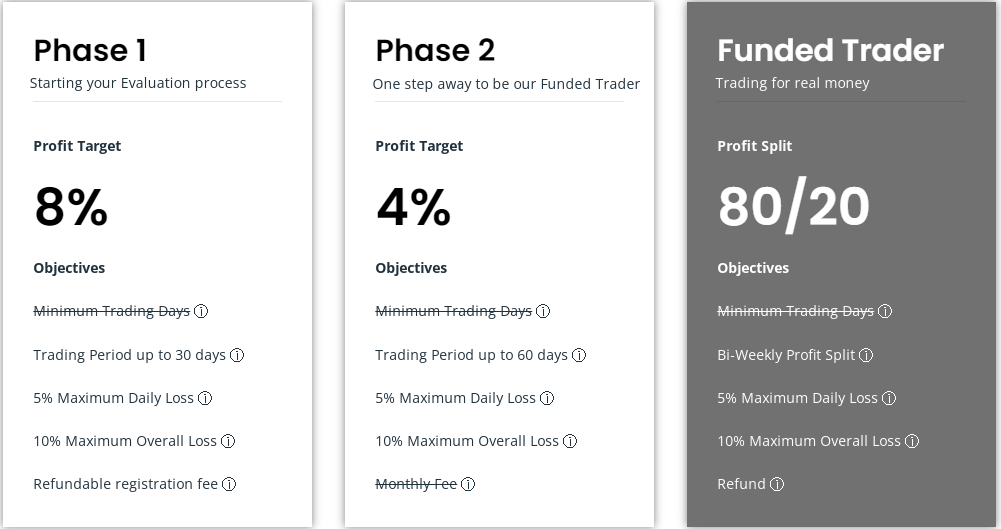

True Forex Funds offer traders funded accounts ranging from $10,000 to $200,000, with the option to scale to $400,000 for those traders getting extremely consistent results. The rules and conditions for trading are much like what you find in some of the best prop firms worldwide, similar to FTMO.

The5ers is a platform and program for funded traders, supporting skilled forex individuals to transition into full-time traders by providing financial backing and growth opportunities.

The objective is to boost the careers of the most talented traders globally, enabling them to achieve greater profits compared to trading currencies independently with limited capital.

The story of the funded account provider begins in 2016 when Gil Ben Hur and Snir Achiel, two professional forex traders, launched the prop trading firm. The founders were united in their views due to a common problem they both had. They had the skills but lacked the capital to gain significant profits. After finding out that many others struggle with the same issue, they decided to launch a career-building platform that supports currency traders from all across the world.

What started as a small community quickly became one of the top prop firms in the industry, enjoying a continuously increasing demand for its products and services. Today, the company operates from its headquarters in Israel but also has a UK office in London.

To date, the prop firm continues to develop and fund skilled beginner and professional traders by allowing them to make profits without risking their own capital. The platform enables users to trade real money from day one without any requirements for qualification or self-funding.

FTMO Are obviously the grandfather of the industry. They were the first ones to start things off and paved the way for other prop firms, like MyForexFunds

FTMO began its operations in 2020 and has experienced substantial growth since its establishment. Currently, FTMO has traders registered in over 180 countries. Over 6 million trades are opened every month, and $27 million have been paid out so far in 2022, with an average payout processing time of only 8 hours.

FTMO has gained recognition in Forbes and achieved the Deloitte Technology Fast 50 award for three consecutive years. Their assessment procedure involves both the FTMO Challenge and the Verification stages. Those who successfully navigate the evaluation process are given the opportunity to join the FTMO Proprietary Trading firm, allowing them to oversee an account balance of up to $400,000.

A comprehensive trading journal for analyzing accounts, coupled with outstanding educational resources, completes the offer and makes it appealing to both novice and experienced traders.

My Forex Funds is a relatively recent entrant in the field, having been established just a year ago in July 2020. By 2022, they had developed a modest brand presence and successfully provided forex trading capital to over 40,000 traders. The company is swiftly emerging as a significant competitor to some of the more established and larger firms, thanks to its excellent reputation and comparable trading conditions. Regular updates to this article reveal that My Forex Funds is positioned as the fastest-growing prop firm in 2022!

Unlike many companies that fund forex traders, My Forex Funds has three different levels or setups, designed for traders at various experience levels, whether you’re just starting out or trading full-time!

If you aim to expand a substantial trading account and potentially extract significant profits from the markets, this company might be the right choice for you.

As mentioned earlier, they provide three types of accounts based on your experience levels, which is excellent. Introducing a novice forex trader to a $100,000 live account with very strict rules would likely lead to disaster, so categorizing accounts based on experience is a thoughtful approach that sets MyForexFunds apart.

We will compare 11 features with 0 to 10 Rate and We will see the best one.

The winner, of course, is clear The 5ers are The Best Funded Trader Program.

Elliott Wave Theory, in a specialized examination, makes sense of cost changes in financial business sectors. Created by Ralph Nelson Elliott, this device examines rehashing fractal wave designs recognized in

Elliott wave analysis is a crucial part of technical analysis. It helps traders and investors understand market trends and potential price changes. Essentially, it says that market prices follow specific

Cryptocurrency trading has become more than just a trend; It is a global phenomenon that has attracted the attention of both experienced investors and newcomers alike. In this comprehensive guide,

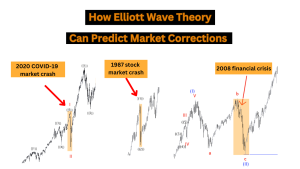

Elliott Wave Theory is a powerful tool that traders and investors use to forecast market movements with great accuracy. In the financial markets, predicting market corrections is crucial for maximizing

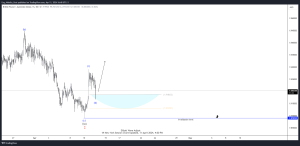

In this technical article we’re going to take a quick look at the Elliott Wave charts of GBPAUD published in members area of the website. Our team recommended members to

Role of The Central Bank: A central bank is a financial organization that supervises a country's money-related system, including cash dissemination and financing costs. They are responsible for advancing financial

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |